1 0 0 0 OA ホートレーからケインズへ

- 著者

- 小峯 敦

- 出版者

- The Japanese Society for the History of Economic Thought

- 雑誌

- 経済学史学会年報 (ISSN:04534786)

- 巻号頁・発行日

- vol.32, no.32, pp.74-85, 1994 (Released:2010-08-05)

- 参考文献数

- 41

Although R. G. Hawtrey (1879-1975) had been an outstanding monetary economist in the 1920s and 1930s, and was greatly respected by Keynes, the subsequent ‘Keynesian Revolution’ made Hawtrey's analysis out-of-date. But recently the situation has been changing. Now it is time for a reappraisal.In a Treasury memorandum entitled “Germany and the Reparations Burden” (Sep. 1928) and in working paper No. 66 of the Macmillan Committee (Jan. 1931), Hawtrey independently devised the ‘multiplier theory’ (that is, if investment increases, output will also increase until additional saving is balanced to additional investment). This preceded the work of R. F. Kahn. Interestingly Keynes (and later Kahn), who read these papers, appreciated Hawtrey's analysis. Nevertheless we cannot insist that Hawtrey's thought including the multiplier theory) influenced Keynes's thought. Why?The clue to solving this paradox lies in the nature of Hawtrey's ‘dealers economics’. He always put stress upon the role of dealers (market intermediaries who hold stocks) and trade fluctuations triggered by money-flow change. On the other hand, Keynes emphasized the role of entrepreneurs and money-stock change (ex. liquidity preference). The difference is deeper than it seems. That is the reason why Hawtrey cannot occupy a crucial place in the making of Keynes's ‘General Theory’.

- 著者

- 塚本 隆夫

- 出版者

- The Japanese Society for the History of Economic Thought

- 雑誌

- 経済学史学会年報 (ISSN:04534786)

- 巻号頁・発行日

- vol.31, no.31, pp.135, 1993 (Released:2010-08-05)

1 0 0 0 OA B. T. McCormick, Hayek and the Keynesian Avalanche, Harvester Wheatsheaf, 1992, xiii+289p.

- 著者

- 吉田 雅明

- 出版者

- The Japanese Society for the History of Economic Thought

- 雑誌

- 経済学史学会年報 (ISSN:04534786)

- 巻号頁・発行日

- vol.31, no.31, pp.136, 1993 (Released:2010-08-05)

- 著者

- 只腰 親和

- 出版者

- The Japanese Society for the History of Economic Thought

- 雑誌

- 経済学史学会年報 (ISSN:04534786)

- 巻号頁・発行日

- vol.31, no.31, pp.137-138, 1993 (Released:2010-08-05)

- 著者

- 新村 聡

- 出版者

- The Japanese Society for the History of Economic Thought

- 雑誌

- 経済学史学会年報 (ISSN:04534786)

- 巻号頁・発行日

- vol.31, no.31, pp.138-139, 1993 (Released:2010-08-05)

- 著者

- 安川 隆司

- 出版者

- The Japanese Society for the History of Economic Thought

- 雑誌

- 経済学史学会年報 (ISSN:04534786)

- 巻号頁・発行日

- vol.31, no.31, pp.140-141, 1993 (Released:2010-08-05)

- 著者

- 林 康二

- 出版者

- The Japanese Society for the History of Economic Thought

- 雑誌

- 経済学史学会年報 (ISSN:04534786)

- 巻号頁・発行日

- vol.31, no.31, pp.141-142, 1993 (Released:2010-08-05)

- 著者

- 村松 茂美

- 出版者

- The Japanese Society for the History of Economic Thought

- 雑誌

- 経済学史学会年報 (ISSN:04534786)

- 巻号頁・発行日

- vol.31, no.31, pp.126, 1993 (Released:2010-08-05)

- 著者

- 奥田 聡

- 出版者

- The Japanese Society for the History of Economic Thought

- 雑誌

- 経済学史学会年報 (ISSN:04534786)

- 巻号頁・発行日

- vol.31, no.31, pp.127, 1993 (Released:2010-08-05)

- 著者

- 川波 洋一

- 出版者

- The Japanese Society for the History of Economic Thought

- 雑誌

- 経済学史学会年報 (ISSN:04534786)

- 巻号頁・発行日

- vol.31, no.31, pp.128, 1993 (Released:2010-08-05)

- 著者

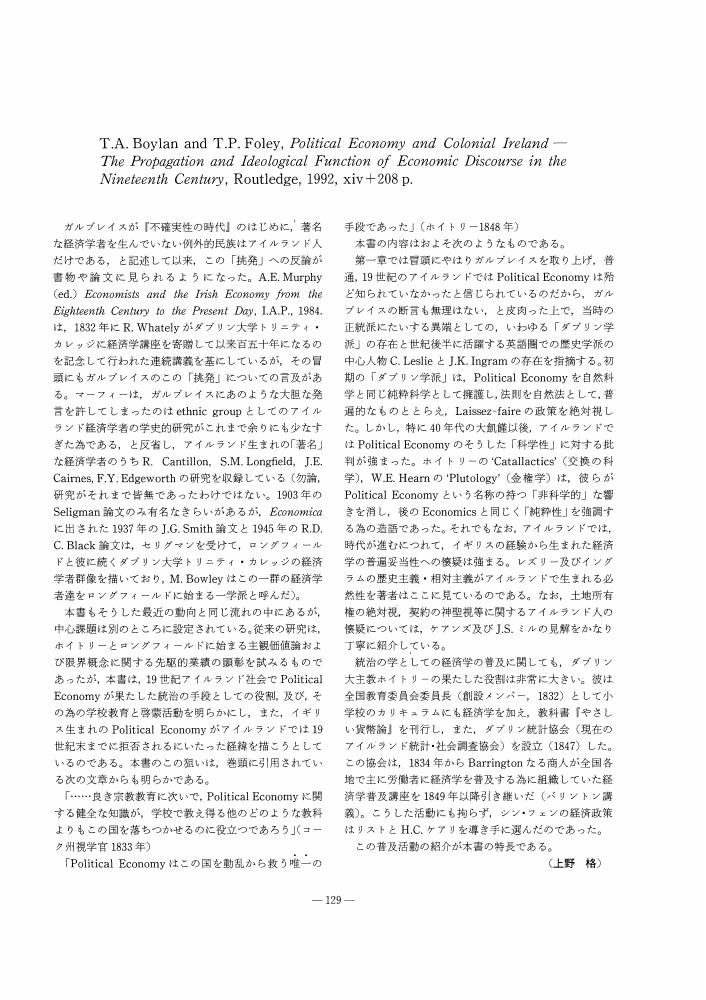

- 上野 格

- 出版者

- The Japanese Society for the History of Economic Thought

- 雑誌

- 経済学史学会年報 (ISSN:04534786)

- 巻号頁・発行日

- vol.31, no.31, pp.129, 1993 (Released:2010-08-05)

- 著者

- 的場 昭弘

- 出版者

- The Japanese Society for the History of Economic Thought

- 雑誌

- 経済学史学会年報 (ISSN:04534786)

- 巻号頁・発行日

- vol.31, no.31, pp.130, 1993 (Released:2010-08-05)

- 著者

- 岩本 吉弘

- 出版者

- The Japanese Society for the History of Economic Thought

- 雑誌

- 経済学史学会年報 (ISSN:04534786)

- 巻号頁・発行日

- vol.31, no.31, pp.131, 1993 (Released:2010-08-05)

1 0 0 0 OA M. A. Pujol, Feminism and Anti-Feminism in Early Economic Thought, Edward Elgar, 1992, viii+228p.

- 著者

- 水田 珠枝

- 出版者

- The Japanese Society for the History of Economic Thought

- 雑誌

- 経済学史学会年報 (ISSN:04534786)

- 巻号頁・発行日

- vol.31, no.31, pp.132, 1993 (Released:2010-08-05)

- 著者

- 礒川 曠

- 出版者

- The Japanese Society for the History of Economic Thought

- 雑誌

- 経済学史学会年報 (ISSN:04534786)

- 巻号頁・発行日

- vol.31, no.31, pp.133, 1993 (Released:2010-08-05)

- 著者

- 黒木 龍三

- 出版者

- The Japanese Society for the History of Economic Thought

- 雑誌

- 経済学史学会年報 (ISSN:04534786)

- 巻号頁・発行日

- vol.31, no.31, pp.134, 1993 (Released:2010-08-05)

1 0 0 0 OA 米市場についての統計学的研究

- 著者

- 池尾 愛子

- 出版者

- The Japanese Society for the History of Economic Thought

- 雑誌

- 経済学史学会年報 (ISSN:04534786)

- 巻号頁・発行日

- vol.31, no.31, pp.80-89, 1993 (Released:2010-08-05)

- 参考文献数

- 71

In the 1930s, many Japanese economists were absorbed by the study of the socalled rice problem, i. e. the instability of the price of rice and its supply. Two organizations were important for the advancement of the study. The Agricultural Economic Society was established for the study on all problems related to rural districts and agriculture in 1924. The Japan Society for the Promotion of Science, which was established in 1932, asked leading applied economists to form a committee for the theoretical and practical study on rice policy in 1933. Y. Yagi constructed the price and quantity indices of rice during one year following Parsons's method. E. Sugimoto was requested by Japan Society for the Promotion of Science to make a statistical study of the law of demand for rice.These early econometric works on rice have been forgotten not only by many economists but also by historians of economic thought. In the 1940s, there was a paradigmatic shift in econometrics. Keynesian macroeconomics and W. Leontief's input-output analysis began to gain popularity in place of the Marshallian single market approach. Also, econometricians became more absorbed in the analysis of the industrial rather than the agricultural sector.

1 0 0 0 OA 啓蒙の担い手と啓蒙末期の諸問題

- 著者

- 篠原 久

- 出版者

- The Japanese Society for the History of Economic Thought

- 雑誌

- 経済学史学会年報 (ISSN:04534786)

- 巻号頁・発行日

- vol.31, no.31, pp.90-97, 1993 (Released:2010-08-05)

- 参考文献数

- 20

1 0 0 0 OA 古典派の経済理論と現代

- 著者

- 堂目 卓生

- 出版者

- The Japanese Society for the History of Economic Thought

- 雑誌

- 経済学史学会年報 (ISSN:04534786)

- 巻号頁・発行日

- vol.31, no.31, pp.98-105, 1993 (Released:2010-08-05)

- 参考文献数

- 44

1 0 0 0 OA オーストリア学派研究

- 著者

- 塘 茂樹

- 出版者

- The Japanese Society for the History of Economic Thought

- 雑誌

- 経済学史学会年報 (ISSN:04534786)

- 巻号頁・発行日

- vol.31, no.31, pp.112-117, 1993 (Released:2010-08-05)

- 参考文献数

- 46