1 0 0 0 OA 同一価値労働同一賃金の原則に基づく職務評価と是正賃金:A生協の事例から

- 著者

- 大槻 奈巳

- 出版者

- 経済理論学会

- 雑誌

- 季刊経済理論 (ISSN:18825184)

- 巻号頁・発行日

- vol.56, no.2, pp.7, 2019 (Released:2021-07-16)

1 0 0 0 OA 資本制社会の下での生産性指標の特徴とその動態

- 著者

- 橋本 貴彦

- 出版者

- 経済理論学会

- 雑誌

- 季刊経済理論 (ISSN:18825184)

- 巻号頁・発行日

- vol.56, no.3, pp.18, 2019 (Released:2021-10-11)

1 0 0 0 OA 中国の経済覇権をどうみるか?

- 著者

- 本田 浩邦

- 出版者

- 経済理論学会

- 雑誌

- 季刊経済理論 (ISSN:18825184)

- 巻号頁・発行日

- vol.56, no.4, pp.44, 2020 (Released:2022-01-17)

1 0 0 0 OA 「朴正熙体制」の経済的成果に関する韓国マルクス経済学界の論争(海外学界動向)

- 著者

- 鄭 淵沼

- 出版者

- 経済理論学会

- 雑誌

- 季刊経済理論 (ISSN:18825184)

- 巻号頁・発行日

- vol.43, no.1, pp.68-78, 2006-04-20 (Released:2017-04-25)

1 0 0 0 OA 特集にあたって(<特集>現代の貨幣・信用論争)

- 著者

- 大友 敏明

- 出版者

- 経済理論学会

- 雑誌

- 季刊経済理論 (ISSN:18825184)

- 巻号頁・発行日

- vol.45, no.2, pp.3-4, 2008-07-20 (Released:2017-04-25)

1 0 0 0 OA マルクス経済学の方法と現代世界

- 著者

- 伊藤 誠

- 出版者

- 経済理論学会

- 雑誌

- 季刊経済理論 (ISSN:18825184)

- 巻号頁・発行日

- vol.54, no.1, pp.46, 2017 (Released:2019-04-08)

1 0 0 0 OA 『経済学・哲学草稿』第1草稿における国民経済学批判の進展について

- 著者

- 菊地 賢

- 出版者

- 経済理論学会

- 雑誌

- 季刊経済理論 (ISSN:18825184)

- 巻号頁・発行日

- vol.56, no.3, pp.49, 2019 (Released:2021-10-11)

1 0 0 0 OA ポランニー派経済人類学の史的展開:市場社会と非市場社会の対立を超えて

- 著者

- 室井 遥

- 出版者

- 経済理論学会

- 雑誌

- 季刊経済理論 (ISSN:18825184)

- 巻号頁・発行日

- vol.54, no.1, pp.75, 2017 (Released:2019-04-08)

1 0 0 0 OA 経済学における価値判断の2つの位置 : センとロビンズの比較から

- 著者

- 玉手 慎太郎

- 出版者

- 経済理論学会

- 雑誌

- 季刊経済理論 (ISSN:18825184)

- 巻号頁・発行日

- vol.49, no.3, pp.68-78, 2012-10-20 (Released:2017-04-25)

This paper aims to reexamine the positions on the value judgment in economics, by using the classification of the "value judgment of the subject" and the "value judgment of the object". The former is the value judgment of the researcher of economics, while the latter is the value judgment of the object of research, namely the motivation of the actor in economic studies. This classification can clarify the point of the contrast between Amartya Sen and Lionel Robbins about economic methodology. It is well known that Robbins eliminated any value judgments from economics, and strictly separated economics from ethics. However, in fact, he eliminated value judgments only in the field of economic science, and he explicitly needed value judgments in his field of political economy. So, the contrast between Sen, who emphasizes the interaction between economics and ethics, and Robbins is not about whether economists should consider value judgments. (Both of them would say "yes" in response to this question.) It must be about whether economists can ignore value judgments in some fields of study in economics. (Only Sen would deny this possibility.) Robbins based his proposition about the objectivity of economics on that of Max Weber. Robbins regarded Weber's Wertfreiheit as an attitude that considered people's value judgments as matters of fact. Robbins believed that we can treat people's value judgments as fact without our own value judgment (namely the value judgment of the subject). This means that Robbins eliminated value judgments of the subject from economic science but took account of value judgments of the object as fact. However, Robbins's understanding is not correct. Surely, Weber insisted that we could treat value judgments of the object as fact. However, in addition, Weber also insisted that in social sciences we cannot eliminate value judgments of the subject; therefore, we must use some Idealtypus in studies. From the perspective of Weber, social science cannot be wertfrei by merely taking the value judgments of the object as fact. In contrast to Robbins, Sen regards both value judgments of the subject and of the object as being inescapable in economics. His proposition about the inescapability of value is based on the philosophy of Hilary Putnam. Putnam points out the collapse of the fact-value dichotomy. He insisted that not only normative analyses but also descriptions and prescriptions are entangled with values (Putnam calls it "the entanglement of fact and value".) All descriptions premise some epistemic values, for example "coherence". Moreover, some descriptions, for example "cruel", essentially involve ethical values. From the perspective of Putnam, Sen concludes that we cannot ignore value judgments in any fields of study in economics. Both welfare economics and descriptive economics need to consider value judgments, not only of the object but also of the subject. In economic studies, we must investigate the way in which description and normative analysis are studied at the same time.

1 0 0 0 『資本論』のエコロジーから考えるマルクスとエンゲルスの知的関係

- 著者

- 斎藤 幸平

- 出版者

- 経済理論学会

- 雑誌

- 季刊経済理論 (ISSN:18825184)

- 巻号頁・発行日

- vol.53, no.4, 2017

1 0 0 0 OA 『マルクス経済学』に対する松尾匡氏の書評へのリプライ(書評へのリプライ)

- 著者

- 大西 広

- 出版者

- 経済理論学会

- 雑誌

- 季刊経済理論 (ISSN:18825184)

- 巻号頁・発行日

- vol.50, no.3, pp.91-93, 2013-10-20 (Released:2017-04-25)

1 0 0 0 OA Kautsky, Lukacs, Althusser and the Retreat from the Economic in Marxism : with the Return in Uno

- 著者

- Richard WESTRA

- 出版者

- Japan Society of Political Economy

- 雑誌

- 季刊経済理論 (ISSN:18825184)

- 巻号頁・発行日

- vol.44, no.2, pp.77-87, 2007-07-20 (Released:2017-04-25)

Development of his economic theory in Capital consumed the better part of Marx's life. Yet, paradoxically, throughout more than a century following Marx's passing, Marxism (the body of thought tracing its lineage to Marx), notwithstanding a fecund heterogeneity, is offered up as essentially a theory of history. Indeed, today, few dispute the view of historical materialism as the center-piece of Marxism, with political economy, portrayed at best as a sub-theory. Analysis in this paper turns upon the question of how what is here dubbed the retreat from the economic in Marxist theory is impelled by the sub-theory role political economy plays in support of historical materialism. The retreat is traced across the work of three prominent Marxist theoreticians-Karl Kautsky, Georg Lukacs and Louis Althusser-each widely accepted as representatives of epochs of Marxist thought. The article then introduces an alternative approach to the relationship between Marxian economics and historical materialism predicated upon a reconstruction of Marxism originating in Japan. It demonstrates how the Japanese Uno approach returns political economy to its rightful place within Marxist theory-effecting a return to Marx.

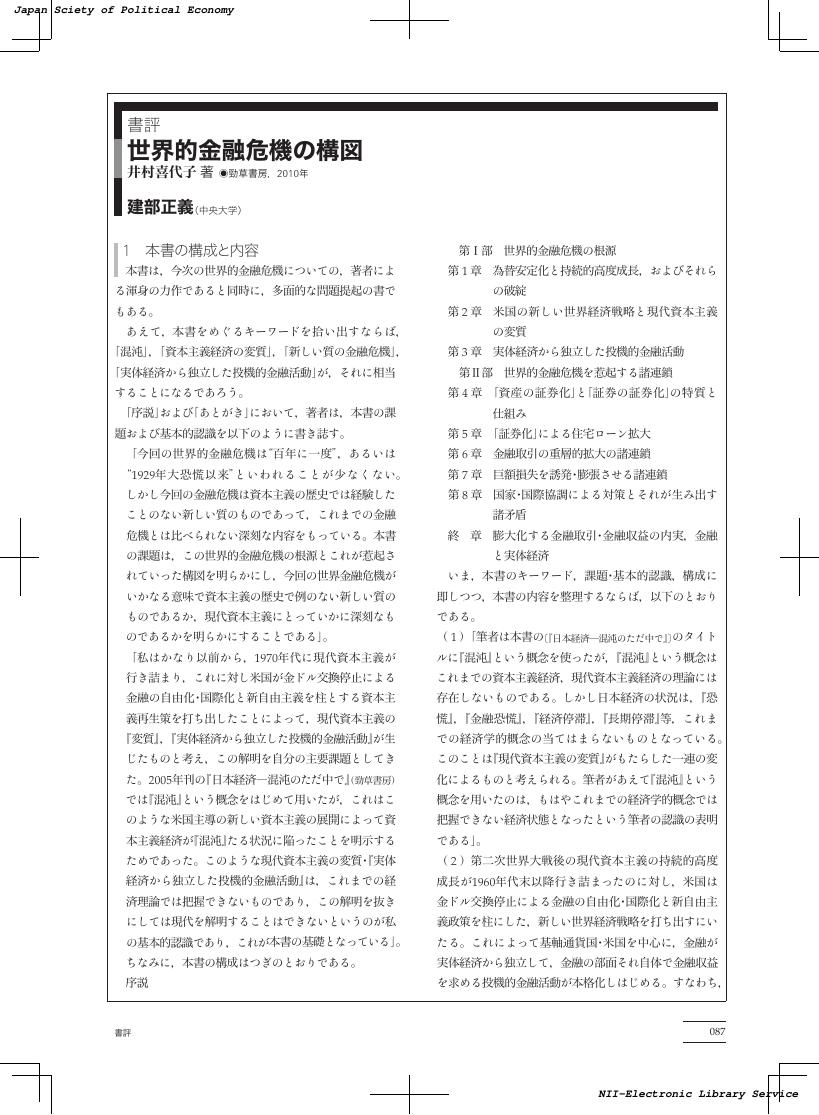

1 0 0 0 OA 世界的金融危機の構図, 井村喜代子著, 勁草書房, 2010年

- 著者

- 建部 正義

- 出版者

- 経済理論学会

- 雑誌

- 季刊経済理論 (ISSN:18825184)

- 巻号頁・発行日

- vol.48, no.3, pp.87-89, 2011-10-20 (Released:2017-04-25)

1 0 0 0 OA 『マルクス経済学方法論批判』への書評をめぐって(書評へのリプライ)

- 著者

- 小幡 道昭

- 出版者

- 経済理論学会

- 雑誌

- 季刊経済理論 (ISSN:18825184)

- 巻号頁・発行日

- vol.51, no.1, pp.77-79, 2014-04-20 (Released:2017-04-25)

1 0 0 0 OA シルヴィオ・ゲゼルの社会主義論と地域通貨の思想

- 著者

- 伊藤 誠

- 出版者

- 経済理論学会

- 雑誌

- 季刊経済理論 (ISSN:18825184)

- 巻号頁・発行日

- vol.51, no.4, pp.58-69, 2015-01-20 (Released:2017-04-25)

In this paper, historical and social significance of ideas and practices of local (or community) currencies are examined, starting from economic thoughts and theories of Silvio Gesell. (1)Gesell's major work Die naturliche Wirtschaftsordnung durch Freiland und Freigeld (1916) was highly appreciated by J. M. Keynes. It aims at socialism with human freedom by abolishing unearned income such as ground rent and interest. In order to abolish ground rent, nationalization of land is to be achieved through offering certain amounts of state bond to private owners of land. The resultant payment of rent to the state is to be redistributed to mothers in proportion to their number of children (just like a sort of basic income). Whereas the idea to nationalize land does not seem particularly unique, Gesell's thoughts and theories of money and interest are quite original. In his view, traditional money has an advantage over all other commodity products physically not to decay or rust. Therefore money can easily be withdrawn from a market without loss, while other commodities are enforced to be sold. Under the circumstances interest is obtainable to money owners like merchants when they exchange their money with other commodities. In order to abolish interest as unearned income, traditional money has to be converted into 'stamp money', which needs carry-over cost like other commodities in the form of duty to stick stamp of one thousandth amount of face value of paper money weekly (so as to make annual rate of 5%). Stamp money would no longer be able to demand interest, and must continuously stay in a market to be exchanged. Thus it must solve also a decisive cause of depression due to money hoarding. This paper would examine significance and weaknesses in Gesell's theories; such as negligence of profit as a more fundamental form of surplus value in a capitalist society, as well as the logical relevance of his theory of interest. (2)Then this paper treats the ideas and historical significance of local currencies, which were initiated under the strong influence of Gesell's arguments in the early 1930s. In many cases to set up local currencies, the form of stamp money was utilized in order to mitigate the economic distress under the Great Depression in local towns and communities. However, as the national economic recovery policies became strengthened, the central governments and central banks prohibited most of local currencies from a view of unified national budgetary and monetary policies at that period. After several decades, the second wave of upsurge of local currencies has globally been conspicuous in our age of continuous economic crises and restructuring since 1970s. The number of local currencies grew rapidly especially since 1990s, and reached more than two thousands in the world, and more than five hundreds in Japan. They are largely facilitated by development of information technologies such as personal computer and mobile phones. Their forms are no longer limited to stamp paper money, but multiplied. For instance cases of Local Exchange Trading System (LETS) organize mutual debit account system through computerized records, without issuing paper money. In most cases of recent local currencies either in LETS type or in paper money type, interest is not paid for saving or debt, by following Gesell's idea. However, those to charge minus interest rate such as stamp money in Gesell's model became rare. At the same time quite a number of recent local currencies intend to organize equal exchange of labour time by using labour time as unit of account or setting money unit proportional to labour time (say 10 dollars per one hour of labour). This idea is disconnected from Gesell's, and follows the genealogy of labour money presented by Ricardian socialists, or R. Owen. In this genealogy, abolishment of surplus value based on exploitation of(View PDF for the rest of the abstract.)

1 0 0 0 OA 特集にあたって(<特集>廣松物象化論と経済学)

- 著者

- 新田 滋

- 出版者

- 経済理論学会

- 雑誌

- 季刊経済理論 (ISSN:18825184)

- 巻号頁・発行日

- vol.48, no.2, pp.3-5, 2011-07-20 (Released:2017-04-25)

- 著者

- 大石 雄爾

- 出版者

- 経済理論学会

- 雑誌

- 季刊経済理論 (ISSN:18825184)

- 巻号頁・発行日

- vol.45, no.1, pp.4-9, 2008

Since the 1980s, the Japanese Gini index, both that of before income redistribution and after, has been steadily increasing and the gap between rich and poor has widened. Recently the index reached the level of 0.5 and now stands at 0.526. The index of Japan classified it as a country with high inequality, along with the USA. The last several years has seen an increase of the profit in the listed companies contributing to a personal income for high level managers and stockholders. On the other hand, there has been a dramatic increase in the number of households we class as working poor and a continual increase in the aged poor. The rise in the working poor could be seen as the core of the problem. Business bodies have actively urged the separate companies to adopt a more flexible employment method where workers are hired as non-regular employees. More than 70% of these non-regular employees work full-time hours. A recent trend of the past several years has seen regular employees replaced by non-regular workers. Because more women tend to work as non-regular employees, they are more likely to be affected by this recent trend. Another big change is that wage conditions are now determined by worker performance. In these situations, regular workers are forced to do more unpaid overtime. Because of longer working hours, the number of workers with mental disorders, the phenomena of "death-by-overworking" and work-related suicide has increased and remains high. Also the highest income tax rate has been lowered with little change in the rates of tax for lower income levels. The introduction of a consumption tax has become a bigger burden on low-income employees. As a result, income redistribution has become ineffective. The level of income to recipients of Social Security payment in Japan is amongst the lowest of OECD nations. There are many working poor who can't be on welfare because of a reluctance of social insurance agencies to help them and the poverty problem is getting serious among aged people. After World War II, Japan established its social regime as a state-monopolistic capitalist system, under which the impressive high economic growth was accomplished. However, as a result of the rapid rise of the productive powers, the intrinsic contradiction of the regime burst into a phenomenon known as stagflation. Gigantic corporations in the developed countries began at first to head overseas to the developing countries. And as a whole, they created the economic structure known as global capitalism. In that process, 'Neo-libertarian Policies' were introduced one after another by the Japanese government. Business bodies in Japan, cooperating with the government, pushed forward with the deregulation of the labor law system, which divided workers into regular employees and non-regular employees. This enabled the extension of disparities in income between these groups. In order to resolve this poverty problem, it is required to stop the increase in the number of poor workers. First of all each company should increase the number of its regular employees rather than the number of non-regular employees. On the other hand the government's role is to review the structure of the labor market. In order to promote such 're-reform', organized labor itself should try to reorganize and strengthen its labor union movement. Secondly, the government should review the Social Securities system and the tax system, which have now little income redistribution effect and rearrange the structure of the welfare-state. Various types of policies introduced for resolving the gap in income would create a substantial amount of effective demand for the companies manufacturing products for Japanese consumers. This expansion of demand should surely promote better business conditions.

1 0 0 0 OA 「格差社会」の深化と市場主義経済学(〈格差社会〉をどうみるか,第55回大会共通論題)

- 著者

- 大石 雄爾

- 出版者

- 経済理論学会

- 雑誌

- 季刊経済理論 (ISSN:18825184)

- 巻号頁・発行日

- vol.45, no.1, pp.4-9, 2008-04-20 (Released:2017-04-25)

Since the 1980s, the Japanese Gini index, both that of before income redistribution and after, has been steadily increasing and the gap between rich and poor has widened. Recently the index reached the level of 0.5 and now stands at 0.526. The index of Japan classified it as a country with high inequality, along with the USA. The last several years has seen an increase of the profit in the listed companies contributing to a personal income for high level managers and stockholders. On the other hand, there has been a dramatic increase in the number of households we class as working poor and a continual increase in the aged poor. The rise in the working poor could be seen as the core of the problem. Business bodies have actively urged the separate companies to adopt a more flexible employment method where workers are hired as non-regular employees. More than 70% of these non-regular employees work full-time hours. A recent trend of the past several years has seen regular employees replaced by non-regular workers. Because more women tend to work as non-regular employees, they are more likely to be affected by this recent trend. Another big change is that wage conditions are now determined by worker performance. In these situations, regular workers are forced to do more unpaid overtime. Because of longer working hours, the number of workers with mental disorders, the phenomena of "death-by-overworking" and work-related suicide has increased and remains high. Also the highest income tax rate has been lowered with little change in the rates of tax for lower income levels. The introduction of a consumption tax has become a bigger burden on low-income employees. As a result, income redistribution has become ineffective. The level of income to recipients of Social Security payment in Japan is amongst the lowest of OECD nations. There are many working poor who can't be on welfare because of a reluctance of social insurance agencies to help them and the poverty problem is getting serious among aged people. After World War II, Japan established its social regime as a state-monopolistic capitalist system, under which the impressive high economic growth was accomplished. However, as a result of the rapid rise of the productive powers, the intrinsic contradiction of the regime burst into a phenomenon known as stagflation. Gigantic corporations in the developed countries began at first to head overseas to the developing countries. And as a whole, they created the economic structure known as global capitalism. In that process, 'Neo-libertarian Policies' were introduced one after another by the Japanese government. Business bodies in Japan, cooperating with the government, pushed forward with the deregulation of the labor law system, which divided workers into regular employees and non-regular employees. This enabled the extension of disparities in income between these groups. In order to resolve this poverty problem, it is required to stop the increase in the number of poor workers. First of all each company should increase the number of its regular employees rather than the number of non-regular employees. On the other hand the government's role is to review the structure of the labor market. In order to promote such 're-reform', organized labor itself should try to reorganize and strengthen its labor union movement. Secondly, the government should review the Social Securities system and the tax system, which have now little income redistribution effect and rearrange the structure of the welfare-state. Various types of policies introduced for resolving the gap in income would create a substantial amount of effective demand for the companies manufacturing products for Japanese consumers. This expansion of demand should surely promote better business conditions.

- 著者

- 松井 暁

- 出版者

- 経済理論学会

- 雑誌

- 季刊経済理論 (ISSN:18825184)

- 巻号頁・発行日

- vol.54, no.2, 2017

1 0 0 0 OA 商品貨幣説の意味すること

- 著者

- 泉 正樹

- 出版者

- 経済理論学会

- 雑誌

- 季刊経済理論 (ISSN:18825184)

- 巻号頁・発行日

- vol.41, no.1, pp.63-73, 2004-04-20 (Released:2017-04-25)

In the theory of commodity money, money is determined as commodity. This prescription, 'money is commodity', entails that even if the 'money' is no longer money, the 'money' is still commodity. But if we strip its function from today's 'money', it is no longer commodity. After the stripping, we get a mere paper, poor metal and the number written on bankbook. From this point, the persuasion of the theory of commodity money is simply questioned. But the theory of commodity money has two contents. One is to consider about essence of money. Another is to consider about reason for existence of money. The question about the theory of commodity money is turned to consideration about the essence of money. In general opinion, this question is the question against metallism. Another content of this theory, consideration about reason for existence of money, treats of logical generation of money. It insists that money generates spontaneously in the market. In this logic, the generation of money is considered from the perspective of exchange itself. As a result, we get commodity money, as it were, automatically. But this prescription, 'money is commodity', is different from the prescription, 'money is commodity', which is drawn from the consideration about essence of money. Obviously these two prescriptions are same phrase. But the content of these prescriptions are different. The matter is how we interpret these same and different prescriptions. In this paper, I consider the theory of commodity money from the viewpoint of reason for existence of money. And this theme is considered as generation of money. In this framework, as I have already mentioned, certain commodity becomes money automatically. But it does not mean that the essence of money is commodity. The theory of commodity money, as reason for existence of money, is the description of human nature, which is given conditions of private property and social division of labor. If say in other words, it describes principle of market. In other theory, 'contract' is the moment of reason for existence of money. It insists that money is the external existence of market. So, money is not able to generate from exchange itself. From this point, this theory requests the power of generating money for 'contract'. In this paper, I try to unify with this theory and the theory of commodity money. It is a trial to unify with internal generation of money and external generation of money. I base internal generation on external generation. It comes from interest to the awareness of real economic phenomenon. If there is the principle behind various economic phenomena, we will be able to comprehend them on the basis of the principle. We should be able to grasp real economy as an amalgam the principle and factors, which bring various phenomena. On this hypothesis, in this paper, I aim to consider influence of the principle upon reason for existence of money.