4 0 0 0 完全な透明マント(不可視装置)の数理

- 著者

- 落合 友四郎 ウルフレオンハード ホセナチェル

- 出版者

- 一般社団法人情報処理学会

- 雑誌

- 情報処理学会研究報告数理モデル化と問題解決(MPS) (ISSN:09196072)

- 巻号頁・発行日

- vol.2008, no.85, pp.99-101, 2008-09-11

不可視装置 (透明マント) とは、光をうまく迂回させて、中にある物体を見えなくする技術であり、いわゆるハリーポッターの透明マントのことである。今回、左手系メタマテリアル (負の屈折率をもつマテリアル) を用いて、等方性媒質において完全な不可視装置 (透明マント) を理論的に設計した。この設計においては、完全な不可視性を実現でき、時間遅れと反射の両方をゼロにすることができる。The aim of an invisibility device is to guide light around any object put inside, being able to hide objects from sight. In this work, we propose a novel design of dielectric invisibility media based on negative refraction that creates perfect invisibility. In this device, both the time delay and the reflection are zero. These findings strongly indicate that perfect invisibility with optically isotropic materials is possible.

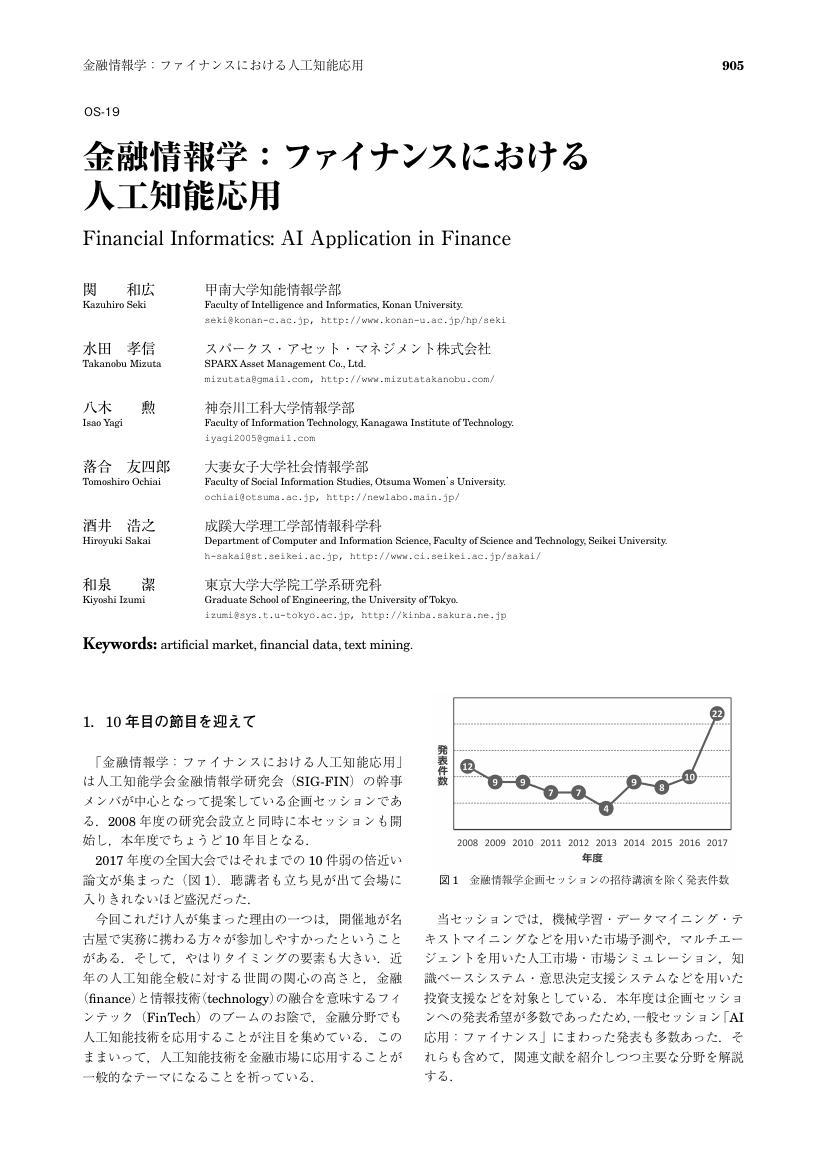

2 0 0 0 OA 「金融情報学:ファイナンスにおける人工知能応用」

- 著者

- 関 和広 水田 孝信 八木 勲 落合 友四郎 酒井 浩之 和泉 潔

- 出版者

- 一般社団法人 人工知能学会

- 雑誌

- 人工知能 (ISSN:21882266)

- 巻号頁・発行日

- vol.32, no.6, pp.905-910, 2017-11-01 (Released:2020-09-29)

- 著者

- 落合 友四郎 レオンハード ウルフ ナチェル ホセ

- 出版者

- 一般社団法人電子情報通信学会

- 雑誌

- 電子情報通信学会技術研究報告. LQE, レーザ・量子エレクトロニクス (ISSN:09135685)

- 巻号頁・発行日

- vol.108, no.114, pp.25-27, 2008-06-20

不可視装置(透明マント)とは、光をうまく迂回させて、中にある物体を見えなくする技術であり、いわゆるハリーポッターの透明マントのことである。今回、左手系メタマテリアル(負の屈折率をもつマテリアル)を用いて、等方性媒質において完全な不可視装置(透明マント)を理論的に設計した。この設計においては、完全な不可視性を実現でき、時間遅れと反射の両方をゼロにすることができる。

- 著者

- 落合 友四郎 ナチェル ホセ

- 出版者

- 一般社団法人 人工知能学会

- 雑誌

- 人工知能学会第二種研究会資料 (ISSN:24365556)

- 巻号頁・発行日

- vol.2015, no.FIN-014, pp.05, 2015-01-21 (Released:2023-01-12)

Recent financial crises have shown the importance of determining the directionality of the in uence between financial assets in order to identify the origin of market unstabilities. Here, we analyze the correlation between Japan's Nikkei stock average index (Nikkei 225) and other financial markets by introducing a volatility-constrained correlation metrics. The asymmetric feature of the metrics reveals which asset is more in uential than the other. As a result, this method allows us to unveil the directionality of correlation effect, which could not be observed from the standard correlation analysis. Furthemore, we present a theoretical model that reproduces the results observed in empirical analysis.

1 0 0 0 「金融情報学:ファイナンスにおける人工知能応用」

- 著者

- 関 和広 水田 孝信 八木 勲 落合 友四郎 酒井 浩之 和泉 潔 甲南大学知能情報学部 スパークス・アセット・マネジメント株式会社 神奈川工科大学情報学部 大妻女子大学社会情報学部 成蹊大学理工学部情報科学科 東京大学大学院工学系研究科

- 雑誌

- 人工知能

- 巻号頁・発行日

- vol.32, 2017-11-01

1 0 0 0 透明マントの設計とその応用研究

- 著者

- 落合 友四郎

- 出版者

- 大妻女子大学

- 雑誌

- 新学術領域研究(研究領域提案型)

- 巻号頁・発行日

- 2011-04-01

透明マントを実現させる上で困難になるポイントとしては、光を大きく曲げるときに、極端に高い(または低い)屈性率を持つ物質が必要となる点である。特に、波長が短くなればなるほど、その波長に対応するメタマテリアルなどの素材を作るのは難しくなる。この高い屈折率をもつ物質が必要となる困難を避けながら、物を隠す方法として、従来の透明マントとは別の方法としてカーペットクローキングが考案された。それは、フラットな鏡の中央部に膨らんだ窪みがあるが、光が入射すると窪みの周りを光が迂回して、外側から見るとあたかも完全にフラットな鏡にみえるという装置である。完全なクローキングを実現するには、高い屈折率が必要であり、技術的な難しさがある。それに比べて、カーペットクローキングはより緩和な屈折率で実現できる。カーペットクローキングを設計する方法のひとつとして、ラプラス変換を用いるやり方を提案したが、ラプラス変換に用いられる関数形と、カーペットクローキングの境界形状の関係が興味深くなる。通常、ラプラス変換に用いられる関数形が決まると、境界形状が決定されるが、この方法の逆問題として、カーペットクローキングの境界の形状からラプラス変換に用いられる関数形を推定する方法論を調べた。また、透明マントの設計方法には、座標変換を用いるもの以外にも、境界条件を用いて定式化する方法もある。これは、座標変換を用いる方法よりも直接的な方法であり、さらに深い知見を得ることができる。いままで考案してきた透明マントの設計を、境界条件を用いる方法で解析した。

- 著者

- 落合 友四郎 レオンハード ウルフ ナチェル ホセ

- 出版者

- 一般社団法人電子情報通信学会

- 雑誌

- 電子情報通信学会技術研究報告. OPE, 光エレクトロニクス (ISSN:09135685)

- 巻号頁・発行日

- vol.108, no.113, pp.25-27, 2008-06-20

不可視装置(透明マント)とは、光をうまく迂回させて、中にある物体を見えなくする技術であり、いわゆるハリーポッターの透明マントのことである。今回、左手系メタマテリアル(負の屈折率をもつマテリアル)を用いて、等方性媒質において完全な不可視装置(透明マント)を理論的に設計した。この設計においては、完全な不可視性を実現でき、時間遅れと反射の両方をゼロにすることができる。