3 0 0 0 OA 中国における埋蔵文化財保護と利活用

- 著者

- 加藤 真二

- 出版者

- 公益社団法人 日本不動産学会

- 雑誌

- 日本不動産学会誌 (ISSN:09113576)

- 巻号頁・発行日

- vol.30, no.3, pp.33-38, 2016-12-26 (Released:2017-12-26)

- 参考文献数

- 10

This paper describes the measures that have been taken for protection and utilization of Chinese buried cultural properties (archeological sites). Measures are discussed and described with emphasis on the provisions of the Law of the Peopleʼs Republic of China on the Protection of Cultural Relics. The third nationwide survey of cultural relics, and a series of rescue excavations carried out by the Henan Provincial Institute of Cultural Relics and Archaeology as well as the preservation of Nanyue palace sites in Guangzhou, Guangdong, are discussed as examples of activities leading to the preservation of archeological sites. The Wangfujing Paleolithic site museum in Beijing, the public archaeological practice at the Shuiliandong cave site in Hebei, and the national archaeological site park at the Zhengzhou Shang dynasty city site in Henan are cited as good examples of the utilization of archeological sites.

3 0 0 0 OA ウォーカビリティと健康な街

- 著者

- 中谷 友樹 埴淵 知哉

- 出版者

- 公益社団法人 日本不動産学会

- 雑誌

- 日本不動産学会誌 (ISSN:09113576)

- 巻号頁・発行日

- vol.33, no.3, pp.73-78, 2019-12-26 (Released:2020-12-26)

- 参考文献数

- 29

- 被引用文献数

- 3 1

The concept of walkability has been emerged in interdisciplinary areas of public health, urban planning, geography, and other related disciplines as environmental characteristics of residential neighborhoods that promote daily walking and physical activity. As studies using perceived and objective environmental indices have been accumulated, it has become clear that walkable residential environments contribute to regional population health through enhancing physical activity of residents in various societies including Japan. Given the relationship between walkability and health, bridging between health policies and urban planning in various geographical contexts becomes increasingly important to design healthy neighbourhoods.

3 0 0 0 OA 米国の住宅ローンはノンリコースか

- 著者

- 竹本 清志

- 出版者

- Japan Association for Real Estate Sciences

- 雑誌

- 日本不動産学会誌 (ISSN:09113576)

- 巻号頁・発行日

- vol.20, no.1, pp.82-87, 2006-06-30 (Released:2011-06-15)

- 参考文献数

- 5

日本では, 一部において, アメリカの住宅ローンはノンリコースローンであると言われている。しかしながら, 州によっては物件売却後の不足額の支払いを命ずる判決について制限する州もみられるものの, 一般に住宅ローンの借り手は, 当初の融資の契約書に従い, 借入れ全額について完全な債務を負うものである。

3 0 0 0 OA 大規模店舗立地問題に関する研究動向と課題

- 著者

- 貞広 幸雄

- 出版者

- 公益社団法人 日本不動産学会

- 雑誌

- 日本不動産学会誌 (ISSN:09113576)

- 巻号頁・発行日

- vol.22, no.4, pp.118-127, 2009-04-10 (Released:2015-07-23)

- 参考文献数

- 60

- 被引用文献数

- 2 1

This paper reviews the papers discussing the evaluation and regulation of big-box retailers in Japan. Topics discussed in papers are classified into one of the four categories:1)descriptive analysis of store location, 2)evaluation of the effects of big-box development, 3)regulation of big-box retail stores, and 4)store closure in downtown area. Outline of existing studies is briefly summarized, from which directions of future studies are shown.

3 0 0 0 OA マンション法制の国際比較

- 著者

- 鎌野 邦樹

- 出版者

- Japan Association for Real Estate Sciences

- 雑誌

- 日本不動産学会誌 (ISSN:09113576)

- 巻号頁・発行日

- vol.16, no.4, pp.103-111, 2003-04-28 (Released:2011-06-15)

- 参考文献数

- 9

This paper aims to compare condominium laws in some countries (Germany, France, USA, U.K.) and to make clear what Japanese law learn from these. What to compare are the creation of condominium, the object of condominium (Unit and Common Property), by-laws and rules of scheme, and management.

2 0 0 0 OA 東京一極集中是正論への疑問

- 著者

- 小峰 隆夫

- 出版者

- 公益社団法人 日本不動産学会

- 雑誌

- 日本不動産学会誌 (ISSN:09113576)

- 巻号頁・発行日

- vol.29, no.2, pp.36-41, 2015-09-30 (Released:2017-01-27)

- 参考文献数

- 6

- 被引用文献数

- 1

- 著者

- 小林 伸幸

- 出版者

- 公益社団法人 日本不動産学会

- 雑誌

- 日本不動産学会誌 (ISSN:09113576)

- 巻号頁・発行日

- vol.31, no.4, pp.129-138, 2018-03-26 (Released:2019-03-26)

- 参考文献数

- 29

- 被引用文献数

- 1

When an incorporated educational institution acquires real estate to establish a school, real estate acquisition tax is tax exemption. There are two interpretations of this tax exemption requirements. One is interpretation that acquisition of real estate to establish a school is a tax exemption requirement. The other is interpretation that the establishment of a school is a tax exemption requirement. This paper discusses this tax exemption requirements, accreditation standards of this tax exemption requirements, and limited interpretation of this tax exemption requirements.

- 著者

- 若林 幹夫

- 出版者

- 公益社団法人 日本不動産学会

- 雑誌

- 日本不動産学会誌 (ISSN:09113576)

- 巻号頁・発行日

- vol.23, no.1, pp.46-51, 2009

2 0 0 0 OA 道路占用許可の規制緩和と屋外都市空間の多目的利用

- 著者

- 板垣 勝彦

- 出版者

- 公益社団法人 日本不動産学会

- 雑誌

- 日本不動産学会誌 (ISSN:09113576)

- 巻号頁・発行日

- vol.33, no.2, pp.46-51, 2019-09-27 (Released:2020-09-27)

- 参考文献数

- 10

The Road Act and its application will be revised in order for roads function as public property convenient and useful for people. It is beneficial to revise the occupancy permit requirements to recognize the diverse purposes of road space, which cover not only the traffic viewpoint but also the revitalization of communities, as the essential purposes of the road. We should pay attention to the relationship with urban space and city planning.

2 0 0 0 OA 不動産法の最前線「不動産取引における心理的欠陥の客観化」 ─裁判例の比較を通じた検討─

- 著者

- 田中 夏樹

- 出版者

- 公益社団法人 日本不動産学会

- 雑誌

- 日本不動産学会誌 (ISSN:09113576)

- 巻号頁・発行日

- vol.33, no.1, pp.89-92, 2019-06-27 (Released:2020-06-27)

- 参考文献数

- 11

2 0 0 0 OA 社会工学と学際教育

- 著者

- 中井 検裕

- 出版者

- 公益社団法人 日本不動産学会

- 雑誌

- 日本不動産学会誌 (ISSN:09113576)

- 巻号頁・発行日

- vol.28, no.4, pp.51-55, 2015-03-25 (Released:2017-01-25)

2 0 0 0 OA 人口減少下におけるインフラ整備を考える視点

- 著者

- 宇都 正哲

- 出版者

- 公益社団法人 日本不動産学会

- 雑誌

- 日本不動産学会誌 (ISSN:09113576)

- 巻号頁・発行日

- vol.25, no.4, pp.43-49, 2012-03-16 (Released:2016-10-19)

- 参考文献数

- 3

- 被引用文献数

- 1 2

The infrastructure management of Japan has problems in both sides of supply and demand. In the demand side, the problems exist in the overseas relocation of industrial activities and also the decrease in population. In the supply side, on the other hand, the problem is the high renewal costs of the aging infrastructure. It is actualizing especially in the local area. The infrastructure management is required in a timely manner. The time management is an important viewpoint in that case. It is required to practice optimization of an infrastructure level in accordance with the demand, and it is important to disclose related the infrastructure information for that purpose.

2 0 0 0 OA 【日本不動産学会セミナー】民法改正で不動産取引はこう変わる

- 著者

- 松尾 弘 石黒 裕章 榎本 英二 関 輝夫 望月 治彦 吉田 修平 植松 丘

- 出版者

- 公益社団法人 日本不動産学会

- 雑誌

- 日本不動産学会誌 (ISSN:09113576)

- 巻号頁・発行日

- vol.32, no.1, pp.5-37, 2018-06-28 (Released:2019-06-28)

2 0 0 0 OA 組合所有は区分所有に代わりうるか

- 著者

- 小林 秀樹

- 出版者

- 公益社団法人 日本不動産学会

- 雑誌

- 日本不動産学会誌 (ISSN:09113576)

- 巻号頁・発行日

- vol.22, no.4, pp.62-67, 2009-04-10 (Released:2015-07-23)

- 参考文献数

- 6

- 被引用文献数

- 1

2 0 0 0 OA 民法改正が不動産売買契約の実務にどのような影響を与えるのか

- 著者

- 望月 治彦

- 出版者

- 公益社団法人 日本不動産学会

- 雑誌

- 日本不動産学会誌 (ISSN:09113576)

- 巻号頁・発行日

- vol.30, no.1, pp.62-67, 2016-06-30 (Released:2017-06-30)

- 参考文献数

- 7

2 0 0 0 OA 報告 米国の不動産流通市場の実態と不動産流通システム

- 著者

- 小林 正典

- 出版者

- 公益社団法人 日本不動産学会

- 雑誌

- 日本不動産学会誌 (ISSN:09113576)

- 巻号頁・発行日

- vol.26, no.2, pp.108-113, 2012-09-28 (Released:2016-11-19)

- 参考文献数

- 5

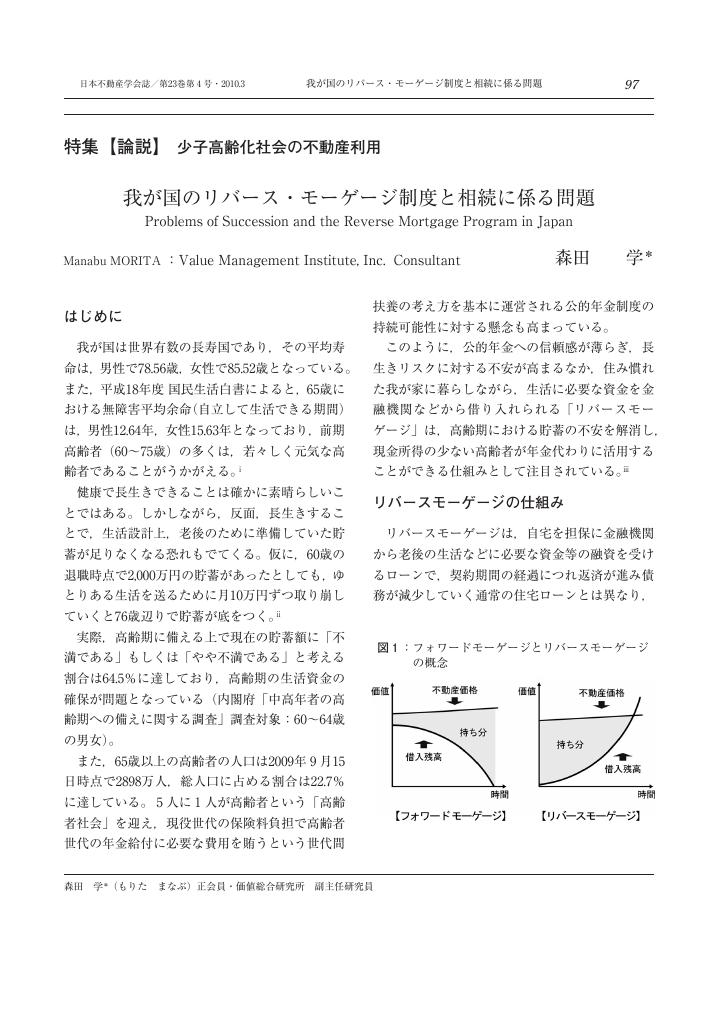

2 0 0 0 OA 我が国のリバース・モーゲージ制度と相続に係る問題

- 著者

- 森田 学

- 出版者

- 公益社団法人 日本不動産学会

- 雑誌

- 日本不動産学会誌 (ISSN:09113576)

- 巻号頁・発行日

- vol.23, no.4, pp.97-102, 2010-03-31 (Released:2015-07-23)

- 参考文献数

- 7

1 0 0 0 OA 人口減少時代における道路ネットワークのスマートな縮減

- 著者

- 根本 敏則

- 出版者

- 公益社団法人 日本不動産学会

- 雑誌

- 日本不動産学会誌 (ISSN:09113576)

- 巻号頁・発行日

- vol.26, no.4, pp.66-69, 2013-03-25 (Released:2017-01-14)

- 参考文献数

- 2

1 0 0 0 OA 京都市の細街路が住宅価格・賃料に及ぼす影響に関する研究

- 著者

- 安田 昌平 宅間 文夫

- 出版者

- 公益社団法人 日本不動産学会

- 雑誌

- 日本不動産学会誌 (ISSN:09113576)

- 巻号頁・発行日

- vol.34, no.1, pp.49-57, 2020-06-29 (Released:2021-06-29)

- 参考文献数

- 9

1 0 0 0 OA 望ましい固定資産税改革

- 著者

- 山崎 福寿

- 出版者

- 公益社団法人 日本不動産学会

- 雑誌

- 日本不動産学会誌 (ISSN:09113576)

- 巻号頁・発行日

- vol.31, no.4, pp.97-101, 2018-03-26 (Released:2019-03-26)

- 参考文献数

- 3

- 被引用文献数

- 1

We present the optimal tax reform about the property tax on land and housing in Japan. Since the property tax on housing, building and equipment becomes the obstacle to the capital formation on land, it should be abolished. On the other hand, the eff ective rate of property tax on land should be raised in order to attain the revenue neutrality for local government. The abolition of tax on housing induces the higher land price which can bear the increase in the property tax on land, so that such a tax reform would make everyone better off.