1 0 0 0 OA コンパクトシティに都市計画として行うべきこと

- 著者

- 村木 美貴

- 出版者

- 公益社団法人 日本不動産学会

- 雑誌

- 日本不動産学会誌 (ISSN:09113576)

- 巻号頁・発行日

- vol.29, no.2, pp.56-60, 2015-09-30 (Released:2017-01-27)

- 参考文献数

- 8

1 0 0 0 〔追悼〕熊田禎宣先生を悼む

1 0 0 0 OA 〔追悼〕熊田禎宣先生を悼む

1 0 0 0 OA 都市の回遊性の概念化に関する考察

- 著者

- 川津 昌作

- 出版者

- 公益社団法人 日本不動産学会

- 雑誌

- 日本不動産学会誌 (ISSN:09113576)

- 巻号頁・発行日

- vol.29, no.1, pp.95-104, 2015-06-25 (Released:2017-01-26)

- 参考文献数

- 23

- 被引用文献数

- 3

In recent years, it is becoming increasingly necessary to revitalize rural areas, improve competitive strategies in commercial areas and promote tourism through the advancement of pedestrian flow in urban areas. In this study, we examined the conceptualization of urban pedestrian flow and in doing so revealed a conceptual structure for it. The concept of high pedestrian flow should both increase productivity through the integration from the supply side and consumption side, as well as contribute to town equity.

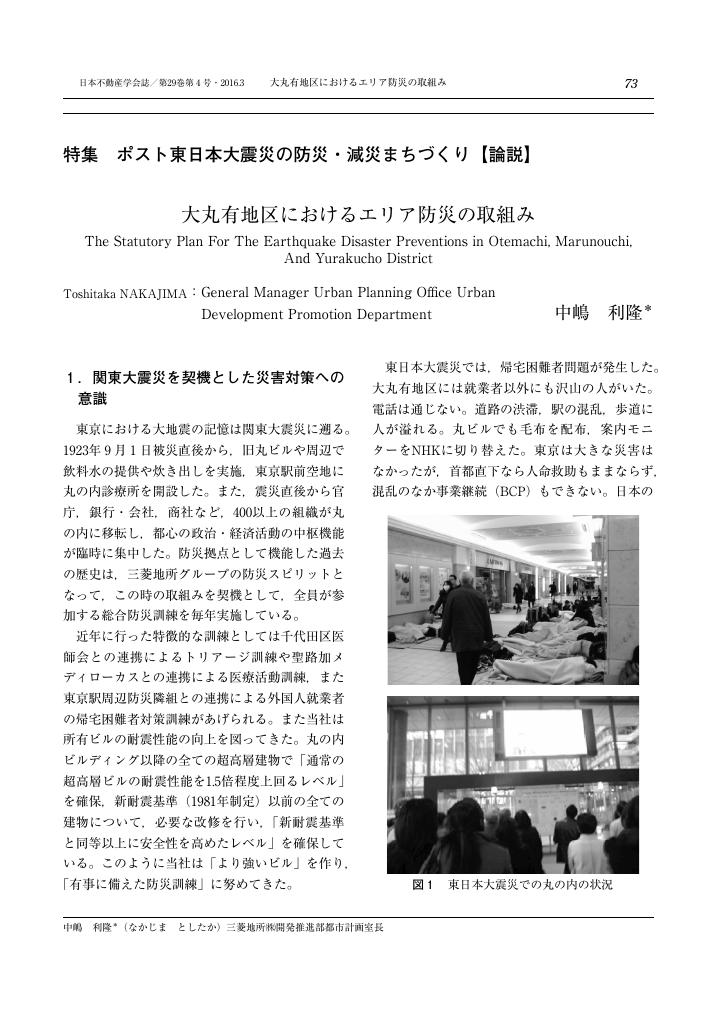

1 0 0 0 OA 大丸有地区におけるエリア防災の取組み

- 著者

- 中嶋 利隆

- 出版者

- 公益社団法人 日本不動産学会

- 雑誌

- 日本不動産学会誌 (ISSN:09113576)

- 巻号頁・発行日

- vol.29, no.4, pp.73-77, 2016-03-28 (Released:2017-03-28)

- 被引用文献数

- 1

1 0 0 0 OA 地方創生政策を評価する:経済学の視点

- 著者

- 山崎 福寿 中川 雅之 瀬下 博之

- 出版者

- 公益社団法人 日本不動産学会

- 雑誌

- 日本不動産学会誌 (ISSN:09113576)

- 巻号頁・発行日

- vol.29, no.2, pp.42-48, 2015-09-30 (Released:2017-01-27)

- 参考文献数

- 10

- 被引用文献数

- 1

1 0 0 0 OA 公共施設更新問題に対する秦野市の取組み

- 著者

- 志村 高史

- 出版者

- 公益社団法人 日本不動産学会

- 雑誌

- 日本不動産学会誌 (ISSN:09113576)

- 巻号頁・発行日

- vol.25, no.4, pp.57-65, 2012-03-16 (Released:2016-10-19)

1 0 0 0 OA 2015年度日本不動産学会学会賞選考結果の報告

- 著者

- 浅見 泰司

- 出版者

- 公益社団法人 日本不動産学会

- 雑誌

- 日本不動産学会誌 (ISSN:09113576)

- 巻号頁・発行日

- vol.30, no.3, pp.86-91, 2016-12-26 (Released:2017-12-26)

1 0 0 0 OA スペース・シンタックス指標を用いた賃料要因分析に関する研究

- 著者

- 太田 明 高橋 大志 兼田 敏之

- 出版者

- 公益社団法人 日本不動産学会

- 雑誌

- 日本不動産学会誌 (ISSN:09113576)

- 巻号頁・発行日

- vol.31, no.4, pp.109-118, 2018-03-26 (Released:2019-03-26)

- 参考文献数

- 15

- 被引用文献数

- 2

As a case study of around the Shibuya station, the multiple regression analysis of housing, office and commercial rent was examined with building and location measures including visibility and integration value by space syntax theory as candidate factor variables. After the factor variables were adopted by t-test, we compared and considered the multiple regression models of housing, office and commercial use, using the factor ranking by t-value. The result showed integration value of space syntax measures were adopted in all models, although the ranking was different in each models.

1 0 0 0 OA 不動産バブルの教訓

- 著者

- 清水 千弘

- 出版者

- 公益社団法人 日本不動産学会

- 雑誌

- 日本不動産学会誌 (ISSN:09113576)

- 巻号頁・発行日

- vol.25, no.1, pp.29-38, 2011-07-20 (Released:2015-10-19)

- 参考文献数

- 12

- 被引用文献数

- 1

The advent and collapse of real estate bubbles, or the sharp rises and falls in real estate prices, have posed major economic issues in many contries. Real estate prices soared sharply in Japan and Sweden in the 1990s and recently in many Western countries (until the mid─2000s), until plunging in the wake of the financial crisis in the United States. The rapid rise and fall of real estate prices in Japan from the mid-1980s to the 1990s is said to represent the most significant real estate bubble of the 20th century. Following the collapse of this bubble, Japan experienced a long period of economic stagnation, often cynically described as the“l ost decades.” What have we learned from these ups and downs in the real estate market? Have recent real estate investment risk management efforts incorporated these lessons? To answer these questions, this paper would like to pay attention to the severalty of each real asset. The lesson learned from last century's economic bubble and from the expansion and shrinkage of the real estate market in the wake of the latest financial crisis is that real estate investment risks cannot be dispersed by diversifying investments, and major risks will remain unless assets are carefully selected.

1 0 0 0 OA 【2013年度秋季全国大会(学術講演会)ワークショップ】 地下水の保全と利用

- 著者

- 守田 優 本間 勝 奥田 進一

- 出版者

- 公益社団法人 日本不動産学会

- 雑誌

- 日本不動産学会誌 (ISSN:09113576)

- 巻号頁・発行日

- vol.27, no.4, pp.115-120, 2014-03-17 (Released:2017-01-20)

- 著者

- 北居 功

- 出版者

- 日本不動産学会

- 雑誌

- 日本不動産学会誌 (ISSN:09113576)

- 巻号頁・発行日

- vol.30, no.1, pp.22-26, 2016

1 0 0 0 所有者不明土地の実態と課題

- 著者

- 吉原 祥子

- 出版者

- 公益社団法人 日本不動産学会

- 雑誌

- 日本不動産学会誌 (ISSN:09113576)

- 巻号頁・発行日

- vol.31, no.3, pp.79-83, 2017

- 被引用文献数

- 1

Abandoned and unclaimed land has emerged as a major policy issue in Japan, where the population is dwindling and property values are falling everywhere but in the big cities. This article analyzes this alarming issue using the results of a nationwide survey conducted by the author targeting 1,719 local authorities, which revealed a disconnect between the existing land ownership system and rapid demographic change. Policy initiatives are needed to address three basic challenges, namely, how to get people to register title transfers when they inherit real estate; how to protect and manage land that has no immediate prospect for use; and how to improve the data collection and management infrastructure.

1 0 0 0 OA 不動産証券化スキームにおける関係者破綻の諸問題とその対応

- 著者

- 岩永 誠

- 出版者

- 公益社団法人 日本不動産学会

- 雑誌

- 日本不動産学会誌 (ISSN:09113576)

- 巻号頁・発行日

- vol.25, no.1, pp.47-52, 2011-07-20 (Released:2015-10-19)

1 0 0 0 OA 賃貸用共同住宅の経年減価に対する居住者の意識構造に関する研究

- 著者

- 小松 広明

- 出版者

- 公益社団法人 日本不動産学会

- 雑誌

- 日本不動産学会誌 (ISSN:09113576)

- 巻号頁・発行日

- vol.32, no.2, pp.127-134, 2018-09-28 (Released:2019-09-28)

- 参考文献数

- 8

In the current empirical study, I verified whether a size difference in square meters affects rental rate reduction based on comments received from tenants occupying the rental units. In apartments under 25 square meters, tenants displayed a sense of antipathy, which affected their recognition of unit depreciation. In contrast, for units larger than 65 square meters, depreciation had a major impact on the perceptions of functional depreciation for tenants.

1 0 0 0 OA 米国の災害対策の現状-訪米調査報告(上)

- 著者

- 三井 康壽 福井 秀夫 四日市 正俊

- 出版者

- 公益社団法人 日本不動産学会

- 雑誌

- 日本不動産学会誌 (ISSN:09113576)

- 巻号頁・発行日

- vol.29, no.1, pp.84-94, 2015-06-25 (Released:2017-01-26)

- 参考文献数

- 3

1 0 0 0 OA 地震災害からの教訓の検証

- 著者

- 三井 康壽

- 出版者

- 公益社団法人 日本不動産学会

- 雑誌

- 日本不動産学会誌 (ISSN:09113576)

- 巻号頁・発行日

- vol.29, no.4, pp.31-40, 2016-03-28 (Released:2017-03-28)

1 0 0 0 OA 不動産物件写真・間取り図を対象とした画像処理技術の最前線

- 著者

- 清田 陽司

- 出版者

- 公益社団法人 日本不動産学会

- 雑誌

- 日本不動産学会誌 (ISSN:09113576)

- 巻号頁・発行日

- vol.31, no.1, pp.64-71, 2017-06-29 (Released:2018-06-29)

- 参考文献数

- 15

- 被引用文献数

- 1

This article describes frontier efforts to apply deep learning technologies, which is the greatest innovation of research on artificial intelligence and computer vision, to image data such as real estate property photos and floor plans. Specifically, attempts to detect property photos that violate regulations or were misclassified, and to extract information that can be used as new recommendation features from property photos, were mentioned. In addition, this article introduces an innovation created by providing datasets for academic communities.

1 0 0 0 OA ビッグデータで見る不動産価格の決まり方

- 著者

- 清水 千弘

- 出版者

- 公益社団法人 日本不動産学会

- 雑誌

- 日本不動産学会誌 (ISSN:09113576)

- 巻号頁・発行日

- vol.31, no.1, pp.45-51, 2017-06-29 (Released:2018-06-29)

- 参考文献数

- 6

- 被引用文献数

- 2

What effect might the development of big data and AI have on the work of real estate professionals ? This paper focuses on the degree to which AI and machine learning may be able to correctly determine real estate prices - a task which occupies a central position in the work of real estate appraisers and brokers. Real estate price determination requires a process where real estate data of varying quality is utilized in the analysis of price formation structures. Furthermore, as the market is in a constant state of flux prices must be determined in response to changes over time. Big data and AI are terms that are commonly used in general conversation. While they do have a complementary relationship they have developed, fundamentally, as diff erent technologies. Recent developments in this area have garnered attention, with a particular focus on advances in big data, and in the context of the development of such an information base the significant improvements in the methods of analysis known as AI and machine learning indicate that such techniques will eventually be able to perform the task of real estate price determination that is currently carried out by appraisers and brokers.