1 1 0 0 大人のための社会科 : 未来を語るために

- 著者

- 井手英策 [ほか] 著

- 出版者

- 有斐閣

- 巻号頁・発行日

- 2017

1 1 0 0 現代日本の社会秩序 : 歴史的起源を求めて

1 1 0 0 出版 : 出版文化の崩壊はくい止められるか

1 1 0 0 新聞 : 転機に立つ新聞ジャーナリズムのゆくえ

1 1 0 0 機長の決断

- 著者

- P.ヴェプファ U.v.シュルーダー[著] 中村昭彦訳

- 出版者

- 講談社

- 巻号頁・発行日

- 1994

1 1 0 0 OA 私のみる日本の学術

- 著者

- James Harry MORRIS

- 出版者

- 公益財団法人 日本学術協力財団

- 雑誌

- 学術の動向 (ISSN:13423363)

- 巻号頁・発行日

- vol.29, no.1, pp.1_94-1_97, 2024-01-01 (Released:2024-04-28)

1 1 0 0 政治的なるものの再興

- 著者

- シャンタル・ムフ著 千葉眞 [ほか] 訳

- 出版者

- 日本経済評論社

- 巻号頁・発行日

- 1998

1 1 0 0 古代国家はいつ成立したか

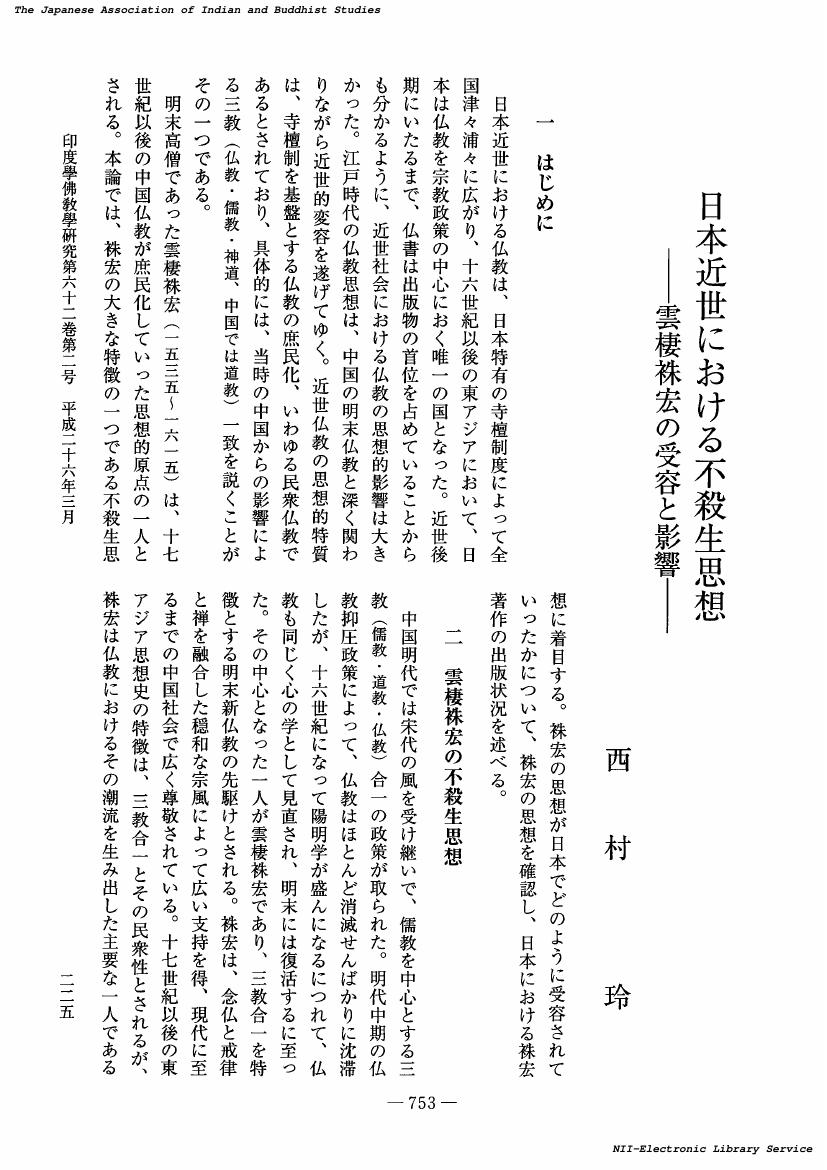

1 1 0 0 OA 日本近世における不殺生思想 ――雲棲袾宏の受容と影響――

- 著者

- 西村 玲

- 出版者

- 日本印度学仏教学会

- 雑誌

- 印度學佛教學研究 (ISSN:00194344)

- 巻号頁・発行日

- vol.62, no.2, pp.753-757, 2014-03-20 (Released:2017-09-01)

1 1 0 0 OA 「障害者と気候変動」をめぐる議論や研究の動向と課題

- 著者

- 丸山 啓史

- 出版者

- 日本発達障害学会

- 雑誌

- 発達障害研究 (ISSN:03879682)

- 巻号頁・発行日

- vol.44, no.1, pp.100-108, 2022-05-31 (Released:2023-10-06)

近年の英語文献をもとに,「障害者と気候変動」をめぐる議論や研究の動向を整理した. 障害者に対する気候変動の否定的影響が多様な側面から指摘されていることを概観し,移住をめぐる問題,気温と体温調節をめぐる問題についても議論や研究が見られることを示した.また,気候変動の影響による災害に関しての障害者の脆弱性,気候変動適応や防災・減災と障害者との関係への関心が強いことを見たうえで,気候変動対策への障害者の参画が重視されるようになってきていることを確認した.今後の研究の課題としては,気候変動の緩和策と障害者との関係を検討するこ と,気候変動対策への障害者の参画のあり方を検討すること,日本における実態や課題を把握すること,気候変動の影響によって機能障害が引き起こされる実態や可能性を把握すること等を挙げた.

- 著者

- 野上 寿

- 出版者

- 公益社団法人 日本薬学会

- 雑誌

- ファルマシア (ISSN:00148601)

- 巻号頁・発行日

- vol.1, no.4, pp.17-18, 1965-04-05 (Released:2018-08-26)

- 著者

- 大沢 勝

- 出版者

- 一般社団法人 日本教育学会

- 雑誌

- 教育学研究 (ISSN:03873161)

- 巻号頁・発行日

- vol.37, no.1, pp.67-69, 1970-03-30 (Released:2009-01-13)