1 0 0 0 OA 〈年間回顧〉

- 著者

- 麻島

- 出版者

- 経営史学会

- 雑誌

- 経営史学 (ISSN:03869113)

- 巻号頁・発行日

- vol.22, no.3, pp.56, 1987-10-30 (Released:2010-05-07)

1 0 0 0 OA 一九八二年の日本経営史

- 著者

- 長沢 康昭

- 出版者

- 経営史学会

- 雑誌

- 経営史学 (ISSN:03869113)

- 巻号頁・発行日

- vol.22, no.3, pp.57-62, 1987-10-30 (Released:2009-11-06)

1 0 0 0 OA 一九八三年の日本経営史

- 著者

- 中村 青志

- 出版者

- 経営史学会

- 雑誌

- 経営史学 (ISSN:03869113)

- 巻号頁・発行日

- vol.22, no.3, pp.62-71, 1987-10-30 (Released:2009-11-06)

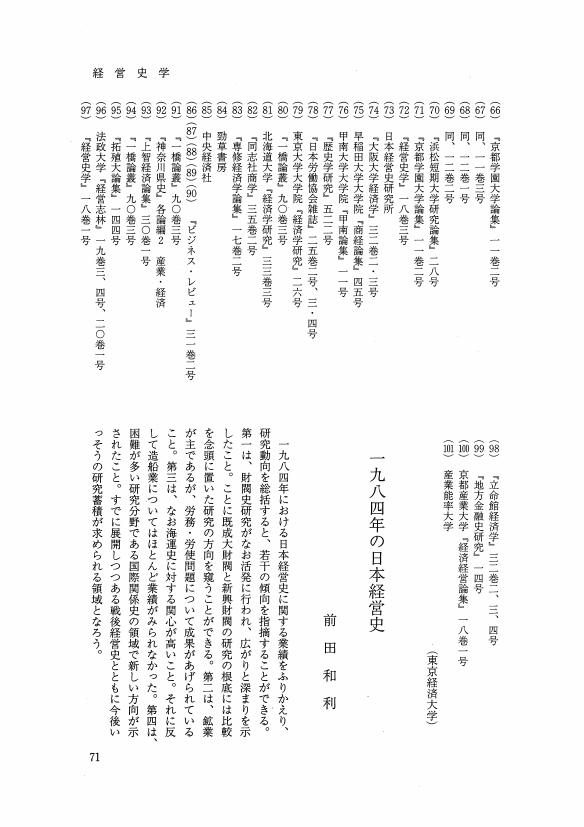

1 0 0 0 OA 一九八四年の日本経営史

- 著者

- 前田 和利

- 出版者

- 経営史学会

- 雑誌

- 経営史学 (ISSN:03869113)

- 巻号頁・発行日

- vol.22, no.3, pp.71-79, 1987-10-30 (Released:2009-11-06)

1 0 0 0 OA 造船企業の社史についての一考察

- 著者

- 柴 孝夫

- 出版者

- 経営史学会

- 雑誌

- 経営史学 (ISSN:03869113)

- 巻号頁・発行日

- vol.22, no.3, pp.90-104, 1987-10-30 (Released:2009-11-06)

1 0 0 0 OA 米国鉄道企業の賃金管理 -バーリントン鉄道の「等級制度」を中心にして-

- 著者

- 大東 英祐

- 出版者

- 経営史学会

- 雑誌

- 経営史学 (ISSN:03869113)

- 巻号頁・発行日

- vol.22, no.4, pp.1-30, 1988-01-30 (Released:2010-11-18)

In the early days of railroading, locomotive engineers were recruited from among mechanics. It was a great recommendation if they had worked for a locomotive manufacturer. They were paid by day, in the same way as mechanics were. Since mechanic turned engineers were skilled in the two trade, they tend to be too proud to be obedient to orders. In the 1870s, however, many railroads including the C.B. & Q. introduced new methods of wage payment, such as the trip system and classification system. At the C.B. & Q., R. Harris introduced a new method by combining the two mentioned just above on Sept. 1, 1876 and reduced wage rates on June 10, 1877. Under the new method, engineers were graded into the four classes in terms of the length of the service which were paid accordingly. Judging from remaining company records, this was due partly to the financial pressure of the prolonged depression of the 1870s. The work can be done for less money than before, by replacing the first class men with the second and the third class men with lower wage rates. However, we must not ignore the long term significance of the new method, under which in order to climb up to the first class one has to be promoted step by step every year. In other words, the method was inseparably tied with the policy of promotion from within. On Nov. 20, 1884, Mr. Rhodes, the superintendent of the motive power, send a circular letter to all the master mechanics of the company instructing “Hereafter please do not employ engineers and firemen who had worked on other roads… In doing otherwise, we are likely to import the bad elements of other roads.” And by the middle of 1880s, the company had developed well a designed employment practices, by which it had attained self-sufficiency in well trained engineers. It goes without saying that this is a great achievement. At the same time, however, it bred discontent among engineers and their brotherhood and caused a bitter strike in 1888.

1 0 0 0 OA 中上川入行前後の三井銀行

- 著者

- 粕谷 誠

- 出版者

- 経営史学会

- 雑誌

- 経営史学 (ISSN:03869113)

- 巻号頁・発行日

- vol.22, no.3, pp.29-55,ii, 1987-10-30 (Released:2009-11-06)

- 被引用文献数

- 1

The amount of deposits of Mitsui Bank increased rapidly after 1886, leading to a corresponding increase in the amount of loans by the bank. In spite of these favorable circumstances, the bank had held a lot of bad loans because it lacked the ability to review requests effectively. T. Masuda, president of Mitsui Bussan Kaisha, was anxious about the state of Mitsui Bank. He asked K. Inoue, the former Minister of Finance, for help and advised T. Nishimura, vice-president of Mitsui Bank, to place more effort at loan collection. But Nishimura didn't translate Masuda's advice into action, as he was a man of indecision. Consequently, Mitsui Bank lost the confidence of bankers and the amount of nongovernmental deposits decreased from 17, 117 thousand yen to 12, 612 thousand yen in the first half of 1891. Masuda complained to Inoue that Nishimura could not cope with the crisis of Mitsui Bank. Then Inoue asked H. Nakamigawa, president of Sanyo Railway Company, to enter Mitsui Bank and institute reforms. Nakamigawa entered Mitsui Bank in August 1891. He collected outstanding loans to Higashi-Honganji and recieved collateral from other borrowers. But I think it must be emphasized that Mitsui Bank had already been recieving collateral prior to Nakamigawa's entry and that he wrote off bad loans by reducing reserve fund which had been maintained since the bank's establishment in 1876. (It had several kinds of voluntary reserve accounts because its financial status in 1876 was very bad.) He was able to pay back the bank's borrowings from the Bank of Japan by the end of 1892 because the bank's deposits had increased and the amount of governmental bonds which it held decresed.

1 0 0 0 OA インド財閥の所有と経営 -その類型的把握-

- 著者

- 三上 敦史

- 出版者

- 経営史学会

- 雑誌

- 経営史学 (ISSN:03869113)

- 巻号頁・発行日

- vol.22, no.3, pp.1-28,i, 1987-10-30 (Released:2009-11-06)

The purpose of this paper is to clarify the ownership patterns and management characteristics of the Indian zaibatsu from the standpoint of the types of the zaibatsu families; a) the joint family type (the Walchands, the Singhanias, the Bajajs), b) the split type (the Goenkas, the Birlas), and c) other types (small family type; the Mahindras, alien type; the Tatas).Some of the concluding observations are as follows : 1) On the whole, inter-corporate investment and multiple directorship as the instrument of control play the significant role in all the zaibatsu, though the pattern varies widely among the groups. Generally it can be said that the larger the joint family is, the stronger tends to be the zaibatsu families' holds over both ownership and management. 2) In the case of the split type, both ownership and management are retained independently by each sub-group of the zaibatsu family. To be noted is the case of the ownership of the R.P. Goenkas, one of the three subgroups of the Goenkas, where a number of investment companies that are subsidiaries of the four main companies of the group play the decisive role in the shareholdings of the group companies. 3) In the Mahindras, the small family type, the main family members hold the ultimate decision making power of the nuclear (holding) company, thereby controling quite a few of their group companies.

1 0 0 0 OA フランス経営史研究の動向 -最近一〇年間を中心に-

- 著者

- 原 輝史

- 出版者

- 経営史学会

- 雑誌

- 経営史学 (ISSN:03869113)

- 巻号頁・発行日

- vol.22, no.1, pp.30-61, 1987-04-30 (Released:2009-11-06)

1 0 0 0 OA 鉄鋼企業史の一考察

- 著者

- 岡崎 哲二

- 出版者

- 経営史学会

- 雑誌

- 経営史学 (ISSN:03869113)

- 巻号頁・発行日

- vol.22, no.1, pp.62-70, 1987-04-30 (Released:2010-02-19)

1 0 0 0 OA 小倉石油と中原延平 -経営者企業の成立条件にかんする一考察-

- 著者

- 森川 英正

- 出版者

- 経営史学会

- 雑誌

- 経営史学 (ISSN:03869113)

- 巻号頁・発行日

- vol.22, no.2, pp.1-29, 1987-07-30 (Released:2009-11-06)

Ogura Oil had long been dominated by Tsunekichi Ogura, the founder and dictatorial leader before he died in 1934, so that no salaried managers could be promoted to the top management post. Nobuhei Nakahara, a chemical engineer of that company graduated from the Tokyo Imperial University, played a major role in solving conflicts within Ogura family and Ogura Oil immediately after Tsunekichi's death and opened his way to the top management. In this process he cooperated with Tamaki Makita, the former senior executive director of Mitsui Mining and a brother in law of Fusazo Ogura, who could become the president of Ogura Oil by the help of Makita and Nakahara. Fusazo, Makita and Nakahara formed the top management of new Ogura. In 1939, Nakahara shifted to the new oil refining company, Toa Nenryo Kogyo which was established by the joint-share holdings of eight oil refining companies including Ogura Oil. This new company was born from the strong desire of the military to guarantee the supply of the high quality gasoline for the wartime purpose. Nakahara's move to the new company was also the product of military.But while working as the top executive of Toa Nenryo, Nakahara continued to have interest in Ogura Oil. When Ogura Oil met the management crisis in 1941 because of the failure of president Fusazo, Nakahara cooperated with Makita to rescue Fusazo and Ogura Oil by merging it with Nippon Oil.

1 0 0 0 OA 第二二回大会統一論題 「近代経営の展開と国際関係」討議報告

- 著者

- 桑原 哲也

- 出版者

- 経営史学会

- 雑誌

- 経営史学 (ISSN:03869113)

- 巻号頁・発行日

- vol.22, no.1, pp.71-81, 1987-04-30 (Released:2009-11-06)

1 0 0 0 OA ガイアナにおけるアルキャン現地子会社の国有化

- 著者

- 梅野 巨利

- 出版者

- 経営史学会

- 雑誌

- 経営史学 (ISSN:03869113)

- 巻号頁・発行日

- vol.22, no.2, pp.30-53, 1987-07-30 (Released:2009-11-06)

In 1971, the government of Guyana nationalized the Demerara Bauxite Co. (Demba), a subsidiary of Alcan Aluminium Ltd., which had been in operation since 1916. This paper aims at clarifying the interaction between Alcan and Guyana until nationalization from the viewpoint of the balance and shift of bargaining power between them.The major findings of this paper are as follows : (1) Unlike the cases of other extractive industries such as copper in Chile and oil in Venezuela, the Guyanese government intervention into Alcan occurred much later. Guyana was a colony of England until 1966, and England depended heavily on Alcan for its supply of bauxite ore and aluminum products especially during the two World Wars. These reasons weakened the bargaining power of Guyana and explain why intervention occurred much later.(2) Alcan was able to maintain its strong bargaining power which was derived from its mainstream bauxite-aluminum operations through the existence of alternative supply sources of bauxite and high entry barriers to the industry.On the other hand, calcined bauxite, which can only be produced in Guyana as it is not found in any other country, gave it bargaining power over Alcan.In conclusion, the interaction of these two forces formed a double bargaining power structure. The nationalization of Alcan by Guyana can be said to be brought about by the latter force.

1 0 0 0 OA オルダム綿紡績業における株式会社の発達とその限界

- 著者

- 日高 千景

- 出版者

- 経営史学会

- 雑誌

- 経営史学 (ISSN:03869113)

- 巻号頁・発行日

- vol.21, no.3, pp.27-52, 1986-10-30 (Released:2009-11-06)

Oldham, the world's largest center of cotton spinning, is also known as the leading center of the early joint-stock company in Britain. From the 1870s to the 1900s, a large number of spinning companies, known as “the Oldham limiteds, ” sprang up in this town, bringing about an unprecedented expansion of the town's spindleage. This paper attempts to reappraise these new companies in the context of the subsequent decline of the British cotton industry in this century.The analysis is focused on the financial problem. Probably, one of the most important characters of the limiteds was in their financial system. The system, as a matter of fact, opened a new source of finance and made possible the emergence of a huge additional spinning capacity, but at the same time it influenced the corporate strategy of the limiteds in such a way as to make them less competitive.The question of why did the decline of the British industry occur is the author's major concern. And this paper is a first step toward clarifying the nature of a mature economy and the factors that affected the British industry's adaptability to changes in the economic environment.

1 0 0 0 OA 一九三〇年代「松下産業団」の形成過程 -事業部制から分社制へ-

- 著者

- 下谷 政弘

- 出版者

- 経営史学会

- 雑誌

- 経営史学 (ISSN:03869113)

- 巻号頁・発行日

- vol.21, no.3, pp.53-75, 1986-10-30 (Released:2009-11-06)

1 0 0 0 OA アメリカ経営史最近一〇年の成果 -工業化初期段階の研究を中心に-

- 著者

- 小林 袈裟治

- 出版者

- 経営史学会

- 雑誌

- 経営史学 (ISSN:03869113)

- 巻号頁・発行日

- vol.21, no.3, pp.76-88, 1986-10-30 (Released:2009-11-06)

1 0 0 0 OA 一九世紀末におけるイギリス植民地銀行の為替業務とポンド利付為替手形

- 著者

- 北林 雅志

- 出版者

- 経営史学会

- 雑誌

- 経営史学 (ISSN:03869113)

- 巻号頁・発行日

- vol.21, no.4, pp.1-28, 1987-01-30 (Released:2010-11-18)

- 被引用文献数

- 1

The price of silver began to fall after 1873. The silver question was one of the most difficult problems facing British colonial banks in the 19th century. British colonial banks, whose operations involved financial transfers between Europe and Asia, suffered from constant fluctuations in exchange rates. This paper is an attempt to investigate how British colonial banks coped with this problem.The violent fluctuations in exchange rates were undermining their business with all silver using countries by introducing into it a strong element of speculation and uncertainty. Under these circumstances, the nature of China's foreign trade, especially the import trade, was undergoing a cmplete change from the late 1880s to the early 1890s, The very unsettled state of exchange rates had been compelling foreign importers to alter their mode of doing business, the socalled “Indent trade”. Under this “Indent trade”, a good deal of the import business passed into the hands of chinese merchants, while foreign importers were becoming merely commission agents. After the Indian mints stopped producing silver coinage in June 1893, the bulk of the “Indent trade” changed from a silver basis to a sterling basis. At this stage, it became possible for manufacturers in Manchester to quote for their piece goods in sterling and to obtain payment by drawing bills of exchange payable sterling on chinese indentors. In this system, the exchange risks inherent in the trade were transferred to chinese importers.As a result, sterling bills came to be widely used in the East and most of the “Indent trade” was conducted on a sterling basis. Through this mode of business, British colonial banks were able to carry on exchange operations on a stable basis, and to make remunerative profits.

1 0 0 0 OA 三菱電機にみる科学的管理法の導入過程 -時間研究法の導入を中心に-

- 著者

- 佐々木 聡

- 出版者

- 経営史学会

- 雑誌

- 経営史学 (ISSN:03869113)

- 巻号頁・発行日

- vol.21, no.4, pp.29-60, 1987-01-30 (Released:2010-11-18)

There were many Japanese electric manufacturers who had introduced “modern” or “scientific” management as well as engineering technique from abroad. However, business historians did not bring forth detailed studies on this topic so far.In this case study, the author clarified the significances of Time Study Method at Kobe factory of Mitsubishi Electric Company in 1925, and analysed the backdrop and process of the introduction of this method and its application to the workshop. Furthermore, the author discussed the diffusion of this method to other Japanese firms.Some results from this investigation are shown as follows.1) As for business circumstances in this period, three fundamental elements were pointed out : the expanding markets, the radical labour movement and the decreasing labour mobility. These changing business conditions urged managers and engineers to reorganize the structure of management at the workshop and to pay attention to the availability of the scientific management method.2) Time Study Method was, first of all, introduced into electric fan shop of Kobe Works by Takeo Kato who had learned the scientific management method at Westinghouse Electric Company after the technical tie-up of the two companies in 1923. At the electric fan shop, the Time Study Method was succesfully applied to the fabricating process, and then the wage rate based on this Time Study, guaranteed the workers the average wage in the industry concerned.3) The Time Study Method from Westinghouse was eventually diffused into the governmental factories such as Kokura Works of the Ministry of Railway and Kure Navy Shipyard. Nobuo Noda and Takeo Kato, pioneering in the introduction of the Time Study Method to Mitsubishi, took an leading role in the scientific management movement in the Showa Era.

1 0 0 0 OA 住友林業の成立と発展

- 著者

- 畠山 秀樹

- 出版者

- 経営史学会

- 雑誌

- 経営史学 (ISSN:03869113)

- 巻号頁・発行日

- vol.21, no.4, pp.61-87, 1987-01-30 (Released:2010-11-18)

1 0 0 0 OA イギリス経営史研究の現状

- 著者

- 湯沢 威

- 出版者

- 経営史学会

- 雑誌

- 経営史学 (ISSN:03869113)

- 巻号頁・発行日

- vol.21, no.4, pp.88-99, 1987-01-30 (Released:2010-11-18)