3 0 0 0 OA 医術開業試験問題集 : 附・医事法令

3 0 0 0 國學院大學図書館所蔵「足利義昭御内書」

- 著者

- 水野 嶺

- 出版者

- 国史学会

- 雑誌

- 国史学 = The journal of Japanese history (ISSN:03869156)

- 巻号頁・発行日

- no.215, pp.111-118, 2015-02

3 0 0 0 OA 粒子形状と生体影響

- 著者

- 京野 洋子

- 出版者

- 日本エアロゾル学会

- 雑誌

- エアロゾル研究 (ISSN:09122834)

- 巻号頁・発行日

- vol.11, no.3, pp.211-217, 1996-09-20 (Released:2010-07-08)

- 参考文献数

- 37

3 0 0 0 OA 帯状疱疹患者における針灸治療の鎮痛効果について

- 著者

- 呉 炳宇

- 出版者

- The Japan Society for Oriental Medicine

- 雑誌

- 日本東洋医学雑誌 (ISSN:02874857)

- 巻号頁・発行日

- vol.45, no.4, pp.893-898, 1995-04-20 (Released:2010-03-12)

- 参考文献数

- 15

帯状疱疹患者52例を針灸で治療し, 49例の患者 (対照群) は漢方薬で治療した。鎮痛効果の尺度として視覚的表現スケール (VAS) を用いた。針灸群は東洋医学の症状鑑別法に基づき, 証による本治法的な針を実施した。それと共に, 皮膚病変部の周囲を取り囲む針治療を実施し, 次いで灸を30分間行った。漢方薬群は肝胆湿熱型には龍胆潟肝湯を投与し, 肝鬱気滞型には逍遥散を投与し, 脾経湿熱型には胃苓湯を与えた。針灸群では, 平均3.8回の治療後に痛みが消えたが, 漢方薬群では, 鎮痛効果の発現に平均5日かかり, しかも3例では無効であった。鎮痛効果の発現率は針灸群で有意に良好であった。針は経絡の気と血を疏通することにより痛みをコントロールすると考えられる。針はまた免疫機能を高めてウイルスの活動を抑制し, それにより鎮痛効果を現すとも考えられる。針灸は帯状疱疹患者の痛みを有意に改善させた。針灸は鎮痛作用を有するといえる。

3 0 0 0 大脳皮質の単位回路

3 0 0 0 IR 準市場の優劣論と障害者福祉の選択制(2)

- 著者

- 児山 正史

- 出版者

- 弘前大学人文社会科学部

- 雑誌

- 人文社会科学論叢 (ISSN:24323519)

- 巻号頁・発行日

- no.7, pp.179-204, 2019-08-30

3 0 0 0 OA 京都名所之内 祇園社雪中

- 著者

- 広重

3 0 0 0 OA 高信頼性風車ブレード素材の開発

- 著者

- 藤田 直博 森野 一英 稲留 将人

- 出版者

- 一般社団法人 日本風力エネルギー学会

- 雑誌

- 風力エネルギー利用シンポジウム (ISSN:18844588)

- 巻号頁・発行日

- vol.37, pp.307-310, 2015 (Released:2017-02-01)

3 0 0 0 OA 頸部の閉鎖性外傷を契機とした後下小脳動脈領域の小脳梗塞2症例

- 著者

- 野村 泰之 濱田 敬永 斎藤 雄一郎 吉田 晋也 遠藤 壮平 鴫原 俊太郎 木田 亮紀

- 出版者

- Japan Society for Equilibrium Research

- 雑誌

- Equilibrium Research (ISSN:03855716)

- 巻号頁・発行日

- vol.57, no.6, pp.608-614, 1998 (Released:2009-10-13)

- 参考文献数

- 17

- 被引用文献数

- 2 2

Recently, because of the development of MRI, it is becoming apparent that there are some cases of cerebellar vascular disorder in the posterior cranial fossa among cases of sudden onset of rotatory vertigo. We reported two cases of sudden onset of rotatory vertigo caused by cerebellar infarction in the territory of the posterior inferior cerebellar artery (PICA) due to cervical occlusive injuries.Case 1. A 48-year-old male sustained a slight whip lash injury and after ten hours, experienced rotatory vertigo and hoarseness. When he came to our hospital, we could only detect hoarseness. However, vascular disorder in the posterior cranial fossa was suggested by the interview. MRI revealed left cerebellar and medulla oblongata infarction.Case 2. A 29-year-old male felt rotatory vertigo and vomited after clicking his neck. Upon closer examination, pure rotatory spontaneous nystagmus, sensory disorder accompanied by sensory dissociation in his face and disability in standing and walking were found, suggesting vascular disorder in the posterior cranial fossa. MRI showed infarction in the left inferior cerebellar region, vermis and left lateral-dorsal medulla oblongata. A dissecting aneurysm in the vertebral artery was found on subsequent angiography.In the Japanese literature, we could find only nine reported cases of cerebellar vascular disorder in the posterior cranial fossa due to the cervical occlusive injuries, in addition to our two cases.The severity of injuries and the period until onset of diagnostic symptoms varied. Therefore, tracing cerebellar vascular disorders due to cervical occlusive injury required not only neurological and neuro-otological findings, but also attention to the history of the original injury and the development of subsequent symptoms. Without a careful interview, it is very difficult to correctly establish the cause of the disorder.

3 0 0 0 IR 準市場としての介護保険サービスの需要と供給についての分析

- 著者

- 田 栄富 励 利

- 出版者

- 久留米大学経済社会研究会

- 雑誌

- 経済社会研究 = The journal of the Society for Studies on Economies and Societies (ISSN:24332682)

- 巻号頁・発行日

- vol.60, no.1, pp.27-57, 2019-11-25

介護保険制度の実施は介護サービスの準市場への移行であり,この準市場において事業者間の競争の存在が確認された。介護サービスの需要と供給動向は介護の社会化を示しており,制度導入の効果ということができる。しかし,介護サービス市場は一般自由市場と異なり,サービス報酬が公定価格のため短期にはサービスの供給は需要の大きさに依存する。介護報酬の改定,第1号被保険者数の増加,要介護認定率,介護サービス受給率等の要因変動は介護サービス市場に大きな影響を与えるが,介護サービスの需要と供給曲線の形は短期と長期で異なったものとなる。また,政府と保険者の政策変化による影響が顕著になっており,準市場としての欠陥も明らかになっている。介護保険財政は賦課方式を採用し,公費投入と介護保険料で賄っている。少子高齢化が進む中で介護財政を維持していくために,政府は公費投入の増加及び介護保険料の引き上げを実施し,介護サービスの需要と供給をコントロールしてきた。しかしながら,これからの認知症高齢者とチャイルドレス高齢者の増加は確実に介護サービス需要増へと繋がり,さらに,介護職員不足の顕著化はサービス供給にも深刻な影響を与える。人口構造と社会経済が大きく変化する中,現在の介護保険制度,準市場としての介護サービス市場はもはや限界に近く,制度を持続可能的に維持していくための抜本的な改革が求められている。

3 0 0 0 IR 「被近代化」の暴力性 : 沖縄女性の風俗改良から「集団自決」まで

- 著者

- 宮城 晴美 Harumi MIYAGI

- 出版者

- 島根県立大学北東アジア地域研究センター

- 雑誌

- 北東アジア研究 (ISSN:13463810)

- 巻号頁・発行日

- no.5, pp.127-145, 2019-12

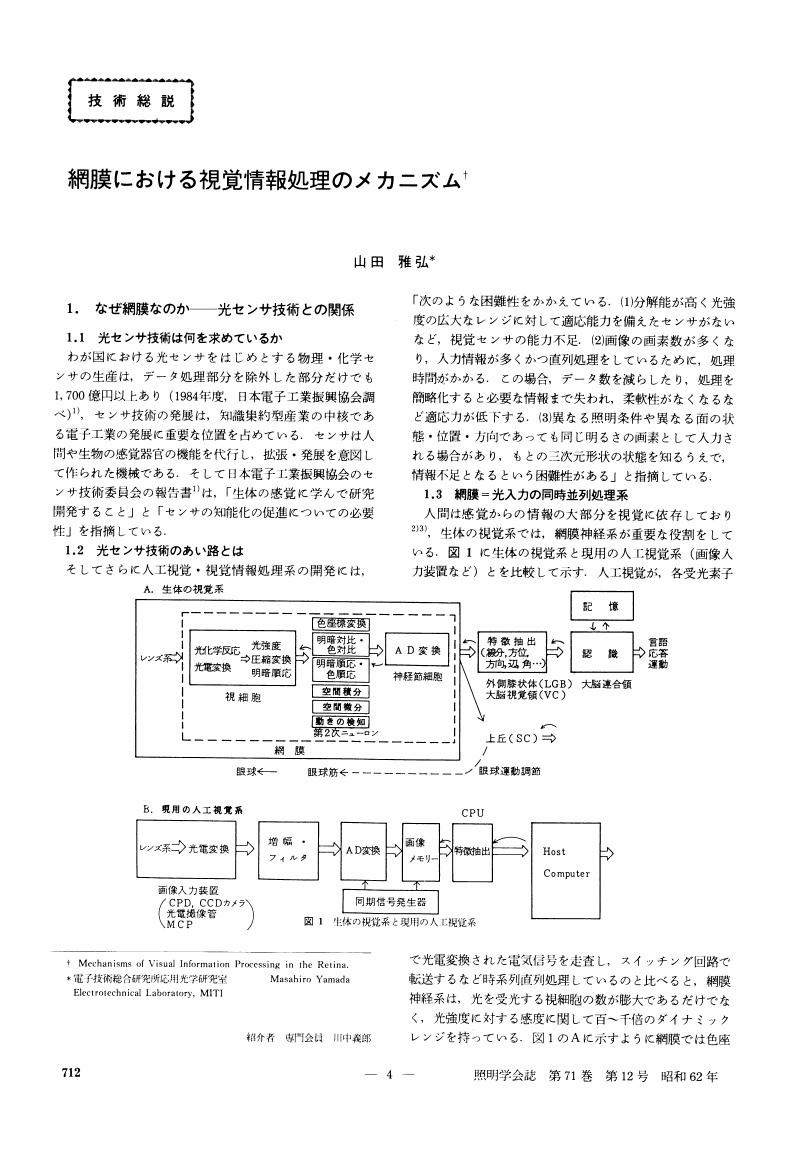

3 0 0 0 OA 網膜における視覚情報処理のメカニズム

- 著者

- 山田 雅弘

- 出版者

- 一般社団法人 照明学会

- 雑誌

- 照明学会誌 (ISSN:00192341)

- 巻号頁・発行日

- vol.71, no.12, pp.712-718, 1987-12-01 (Released:2011-07-19)

- 参考文献数

- 26

- 被引用文献数

- 1

3 0 0 0 OA 豊田利三郎と豊田業団

- 著者

- 牧 幸輝

- 出版者

- Business History Society of Japan

- 雑誌

- 経営史学 (ISSN:03869113)

- 巻号頁・発行日

- vol.46, no.2, pp.2_49-2_73, 2011 (Released:2014-09-10)

This article aims to explore the business vision of Risaburo Toyoda and examine his management of Toyoda Gyoudan [Toyota Industrial Group(TIG)] with emphasis on his entrepreneurial network. Although, Kiichiro Toyoda is well known as the “founder” of Toyota Motor Corporation, in fact, he was not in a position to make final decisions. His brother-in-law, Risaburo, was the president of Toyota Motor Corporation as well as the CEO of TIG. Therefore, the study of TIG including Toyota Motor Corporation must devote special attention to Risaburo. Nevertheless, he has not been judged rightly, and has often been regarded as a hindrance to Toyota's rise in the automobile business. This article aims to reexamine his positive role and the organizational structure of TIG, regarded as a “local Zaibatsu”.One of the most important facets of Risaburo was why he decided to enter the automobile industry. This article shows that in the 1930s, he had predicted the rise of Japan's heavy industry and the decline of its textile industry, and he managed to convert TIG's basic business from textiles to heavy industries.It is well known that Zaibatsu and Emerging Corporate groups were disorganized during the wartime economy due to diversification of affiliated companies. On the other hand, TIG, which was a late-comer in the corporate group, was still primarily controlled by the Toyoda family. A lack of external capital needed to enter the automobile business along with wartime corporate controls had threatened its management structure, but Risaburo secured cooperative stakeholders and reorganized TIG, making Toyota Kinyu [Toyota Finance Company] a holding company. Consequently, TIG kept the family-controlled management structure. In this process, Risaburo made the most of his entrepreneurial network and exercised leadership as the CEO.

3 0 0 0 OA 1920年富士瓦斯紡績押上工場争議の分析 「団結権」 獲得を巡る攻防の光と影

- 著者

- 金子 良事

- 出版者

- 経営史学会

- 雑誌

- 経営史学 (ISSN:03869113)

- 巻号頁・発行日

- vol.42, no.3, pp.5-34, 2007-12-25 (Released:2010-03-19)

- 参考文献数

- 195

3 0 0 0 OA 不定期船マーケットの変貌とオーナー船主

- 著者

- 田付 茉莉子

- 出版者

- 経営史学会

- 雑誌

- 経営史学 (ISSN:03869113)

- 巻号頁・発行日

- vol.37, no.4, pp.1-24, 2003-03-25 (Released:2010-11-18)

After World War I, Japanese shipping suffered for a long time from an excess of tonnage and severe competition. How could Japanese shipping companies cope with the depression when they were mostly latecomers with less cargo and with small company size? The smaller trampers and owners were disadvantaged by these circumstances because they could not keep sufficient volumes of cargo to operate their ships. Many of them, of course, went bankrupt. But a considerably large number of small companies survived, changing their strategies; some of them found cargo in Near Seas, and others specialised in ownership. It was the growing demands of in the chartering market that offered them new business opportunities.S. Tsutsui and Kaiyo Steamship Co., which he established later, were also small owners. Although a very small owner, he became acquainted with G. Hori, a broker in Yamashita and achieved steady growth, chartering out his ship mainly to Yamashita. Kaiyo Steamship took advantage of the government's “scrap and build policy” and acquired bigger ships, which brought good performance to its business. Kaiyo Steamship grew steadily even under the wartime economic controls and built new ships. They chartered them out to the shipping authority and lost most of them in Japan's defeat in World War II.The growth of small owners was, undoubtedly, a consequence of the development of Japanese shipping. I would like to put emphasis, however, on their contribution. Operators could not have extended their business rapidly and widely without chartering significant tonnage at greatly reduced fees, because they had to play second fiddle in the world shipping market. From this point of view, the activities of small owners are one characteristic of Japanese shipping, though it was evident not only in shipping but also in most manufacturing industries.

3 0 0 0 OA 明治期鉄鋼問屋の成立と展開 -大阪鉄商津田勝五郎商店の成立と展開-

- 著者

- 長島 修

- 出版者

- 経営史学会

- 雑誌

- 経営史学 (ISSN:03869113)

- 巻号頁・発行日

- vol.32, no.2, pp.1-26, 1997-07-30 (Released:2009-11-06)

Japan's iron and steel supply depended upon the import from European countries. Japanese traders could hardly deal with the imported goods because foreign traders almost occupied the iron and steel import dealing. Hikitorisyo (Japanese import trader) intermediated between Japanese distributors and foreign traders. Tsuda Katsugoro who came from Hikitorisyo was one of the most famous distrbutors at Osaka. At first when he worked for Kawasaki Shipbuilding Co., he was headhunted by H.E. Reynell who lived at Kobe and imported wine, spirits and so on. He worked for Reynell and Co. After he was independent of Reynell's financial help because of his bankrupt, Mitui Bank, one of the biggest Japanese bank, gave him the financial help so that Tsuda, though he could refuse foreign trader's financial dependence, deeply had to depend upon Mitsui's finance. He started as the dealer, chiefly sold to government office and Navy, and built his local branches in order to sell foreign goods. He sold ship equipments, steel machines, steel goods and so on, which he imported through foreign merchants and big home traders, to home small traders and iron makers. After his independence from Reynell, he changed his business strategy, firmly dealt with the imported iron and steel and distributed them to local merchants, because he also experienced the risk of Hikitorisyo business in spite of the fact that he made a profit during Japan China War (1894-95). In the Meiji era extending business chance, he was one of the innovative successful merchants in a short period. The small merchant such as Tsuda played an important part in the industrialization in Meiji era.

3 0 0 0 OA 工場と都市 -ルノー社 (一九一九-五二) の事例-

- 著者

- パトリック フリーデンソン

- 出版者

- 経営史学会

- 雑誌

- 経営史学 (ISSN:03869113)

- 巻号頁・発行日

- vol.28, no.3, pp.55-65, 1993-10-30 (Released:2009-11-06)

- 参考文献数

- 20

3 0 0 0 OA 鉄道会社史に関する一考察 (東日本篇)

- 著者

- 老川 慶喜

- 出版者

- 経営史学会

- 雑誌

- 経営史学 (ISSN:03869113)

- 巻号頁・発行日

- vol.23, no.3, pp.48-61, 1988-10-30 (Released:2009-11-06)

3 0 0 0 OA 山口財閥の発展と解体 -中規模金融財閥の研究-

- 著者

- 三島 康雄

- 出版者

- 経営史学会

- 雑誌

- 経営史学 (ISSN:03869113)

- 巻号頁・発行日

- vol.18, no.2, pp.23-51,ii, 1983-07-30 (Released:2009-11-06)

The origin of Yamaguchi Zaibatsu was opened by Kichirobei Yamaguchi (first) as a draper at Osaka in 1824. Kichirobei (second) changed his business to money-changer in 1863. After the Meiji Restoration, Yamaguchi family established 148th National Bank in 1879, and this bank changed to private. Yamaguchi Bank in 1898. Thereafter, Yamaguchi family invested to Nihon Seimei (life insurance), Osaka Chochiku Ginko (savings bank), Kansai Shintaku (trust company), Kyodo Kasai Kaijo (fire and marin insurance) and so on. Yamaguchi family established Yamaguchi Limited Partnership (¥10, 000, 000) as holding company in 1920 and formed Yamaguchi Zaibatsu. It had developed as a middle-scale financial Zaibatsu untill the end of second World War. The reasons of development were : 1. delegations of management power to able managers, 2. good selections of investments to stable financial and insurance companies, 3. effective utilizing of capitals by reducing the percentage of investment to 10-50% in all capitals of these companies. After the second World War, Yamaguchi Zaibatsu was not designated to Zaibatsu holding company by the Supreme Commander of Allied Forces, but it was going way of dissolution by the huge property tax, and the decreasing of values of holding stocks. Yamaguchi Limited Partnership closed its 30 years history in 1950.