11 0 0 0 茶葉力テキン類のインフルエンザウイルスに対する不活化作用

- 著者

- 手塚 雅勝 鈴木 弘美 鈴木 康夫 原 征彦 岡田 昌二

- 出版者

- 公益社団法人日本薬学会

- 雑誌

- 衛生化学 (ISSN:0013273X)

- 巻号頁・発行日

- vol.43, no.5, pp.311-315, 1997-10-31

- 参考文献数

- 13

- 被引用文献数

- 10

The effects of catechins obtained from the hot water extract of green tea leaves on two human type-A influenza virus strains of Aichi/2/68 and PR/8/34 were studied. In this study, (-)-epicatechin (EC), (-)-epigallocatechin (EGC), (-)-epicatechin gallate (ECg), (-)-epigallocatechin gallate (EGCg), the crude catechins containing these catechins and (+)-catechin were used. Consequently it was observed that catechins used in this study had an inhibitory effect on the hemolytic activity to red blood cells induced by these two type-A virus strains under acidic conditions (pH 5.1 or 5.4) although they did not have an influence on the agglutination activity to red blood cells induced by the same virus strains. After incubation of (-)-ECg and (-)-EGCg with A/Aichi/2/68 virus, MDCK cells, virus-sensitive cells, were infected with the virus and the ability of virus proliferation was measured in terms of an index of the agglutination activity of the virus to red blood cells. The used two catechins, (-)-ECg and (-)-EGCg, inhibited the virus proliferation at concentrations of 100μg/ml and 50μg/ml, respectively. Furthermore, at a concentration of 2.0 mg/ml these two catechins were found to inhibit the activity of neuraminidase on the surface of the virus membrane by 71.3% and 60.8%, respectively. From the above-mentioned results, it is considered that among the catechins contained in green tea leaves, such two catechins as (-)-ECg and (-)-EGCg inhibit the activity of neuraminidase present on the surface of human influenza virus in order to block the invasion of the influenza virus into virus-sensitive cells.

6 0 0 0 OA 羽田空港D滑走路の設計

- 著者

- 野口 孝俊 渡部 要一 鈴木 弘之 堺谷 常廣 梯 浩一郎 小倉 勝利 水野 健太

- 出版者

- 公益社団法人 土木学会

- 雑誌

- 土木学会論文集C(地圏工学) (ISSN:21856516)

- 巻号頁・発行日

- vol.68, no.1, pp.150-162, 2012 (Released:2012-02-20)

- 参考文献数

- 16

- 被引用文献数

- 1

東京国際空港(羽田空港)は,日本の国内航空ネットワークのハブ空港となっている.増加する旅客数に対して発着能力が限界に達していることに加え,国際線発着枠の拡大に対する要請も強い.そこで,新たな離発着能力を創出するために,沖合に4本目の滑走路を新設する羽田空港再拡張事業が2007年3月末に着工され,2010年10月末に供用開始した.羽田空港D滑走路の建設事業は,軟弱地盤が厚く堆積する地盤上の建設であること,河口部に位置するため,洪水時の河川流量を確保する観点から,一部に桟橋構造が採用されていること,短い工事期間が設定されたことなどから,最新の土木技術を集結し,さまざまな設計・施工上の工夫をした.本稿は,当該事業について,主に地盤工学の立場から,事業内容,地盤調査,人工島設計の概要をとりまとめたものである.

4 0 0 0 日本語プログラム言語"まほろぱ"の文法と記述評価

- 著者

- 今城哲司 鈴木 弘 大野 治 植村 俊亮

- 出版者

- 一般社団法人情報処理学会

- 雑誌

- 情報処理学会論文誌プログラミング(PRO) (ISSN:18827802)

- 巻号頁・発行日

- vol.41, no.4, pp.90-90, 2000-06-15

約20年前からコンピュータでの漢字利用が普及し,標準プログラム言語で日本語データ処理が可能となった.日本語処理は,国際規格化されていて,いくつかの言語では,識別名にも漢字などマルチオクラット文字が使用できる.予約語まで日本語にした本格的な日本語プログラム言語も,分かち書きのレベルで,実用化されている.本論文では,分かち書きをしない,より日本語に近い日本語プログラム言語"まほろば"の設計思想と文法について述べ,実装実験による評価について報告する.Twenty years ago, programming languages have acquired an ability to handle Japanese. Generalizing it to internationalization (i18n), many of i18n facilities of each programing language were accepted as ISO standards. Some programming languages allow users to use user-defined words in such multi-octet characters as kanji. Some new Japanesebased programming languages have also been developed and used. In all those languages, keywords and grammar are based on Japanese, but words have to be separated by spaces. This paper discusses a non-separated (No wakachigaki) version ofJapanese-based programming langage"Mahoroba"."Mahoroba" is a word of ancient Japan, and means a nice country. The paper describes its design philosophy, syntax and evaluation by experimental implementation.

4 0 0 0 OA 俳句から連想する心象風景の構成と心理的評価の研究

- 著者

- 積田 洋 竹内 政裕 鈴木 弘樹

- 出版者

- 日本建築学会

- 雑誌

- 日本建築学会計画系論文集 (ISSN:13404210)

- 巻号頁・発行日

- vol.76, no.669, pp.2093-2099, 2011-11-30 (Released:2012-02-23)

- 参考文献数

- 8

- 被引用文献数

- 2

In this study, pictures of components of imagined scenery, which were imagined from the words of 20 haiku, were drawn. To clarify psychological influences, psychological experiments basing on SD method, were performed. Both of the results were quantified to numerical value and quantification analysis was performed. As the results:1) Base on the factor analysis, 8 factor axes that have influences on the structure of psychological evaluation were extracted.2) Base on grid analysis, the results such as when considering a landscape, direction of the sun, in particular the south was being considered, were obtained. 3) Base on correlation analysis, the results such as the dusk, the sun...were effective elements which direct various scenery, were obtained. 4) Base on multiple correlation analysis, the results such as when an element of the background such as mountain was put into scenery, it would contribute to broadening the landscape, were obtained. Above various structures of imagined scenery, which were imagined from the words of haiku, were captured and the fundamental documents of scenery and landscape were objectively showed.

3 0 0 0 OA 無信号の食い違い二段階横断施設による利用者挙動と意識に関する研究

- 著者

- 村井 宏徳 加藤 明里 神戸 信人 高瀬 達夫 鈴木 弘司 森田 綽之

- 出版者

- 一般社団法人 交通工学研究会

- 雑誌

- 交通工学論文集 (ISSN:21872929)

- 巻号頁・発行日

- vol.3, no.2, pp.B_67-B75, 2017-02-01 (Released:2017-02-01)

- 参考文献数

- 2

宮崎県児湯郡川南町の一般国道 10 号には,沿道商業施設の往来等から,乱横断する歩行者・自転車が多く,死亡事故が発生する単路区間が存在していた.このため,交通安全対策として,我が国で初めて信号機を設置せず,横断歩道を食い違いに配置した無信号の食い違い二段階横断施設が導入された.本研究は,我が国で初めて導入された,この二段階横断施設の導入効果を明らかにするために,導入前後に実施した各種調査の結果を用いて,二段階横断施設の安全性,円滑性の評価と,横断特性の変化を分析した.分析の結果,二段階横断施設の利用者が増加して乱横断が減少し,車両と接近した横断の減少や横断待ち時間の短縮等の安全・円滑面の効果が確認できた.また,歩道部より横断待ち時間が短縮する等の食い違い二段階横断の特性が確認できた.

- 著者

- 鈴木 弘孝 中山 浩成 田代 順孝

- 出版者

- 日本緑化工学会

- 雑誌

- 日本緑化工学会誌 (ISSN:09167439)

- 巻号頁・発行日

- vol.33, no.1, pp.158-163, 2007-08-31

- 被引用文献数

- 3 3

都市のヒートアイランド現象の対策として有力視されている屋上や壁面等建物緑化による温熱環境改善効果を定量的に把握することを目的として,実在の街区をモデルとしてCFD(計算流体力学)解析を行い,建物緑化の違いによる街区内での温度と湿度の変化について数値解析を行った。解析の結果,対象街区での緑化なしに比べて,地表面・屋上の緑化と壁面緑化を組み合わせた場合,気温では街区中心部で最大で約4℃の低減,湿度では最大16%の上昇が見られ,実在街区を対象とした建物緑化による温熱環境改善効果の定量的な評価の可能性が示唆された。

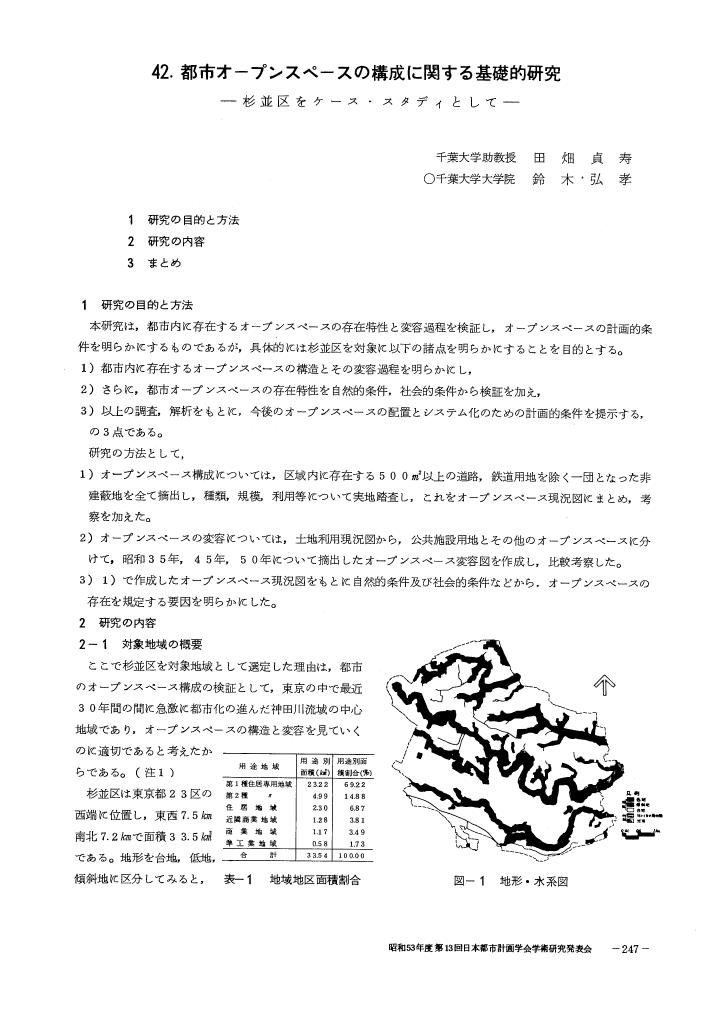

2 0 0 0 OA 都市オープンスペースの構成に関する基礎的研究 杉並区をケーススタディとして

- 著者

- 田畑 貞寿 鈴木 弘孝

- 出版者

- 公益社団法人 日本都市計画学会

- 雑誌

- 都市計画論文集 (ISSN:09160647)

- 巻号頁・発行日

- vol.13, pp.247-252, 1978-10-25 (Released:2020-10-01)

- 参考文献数

- 10

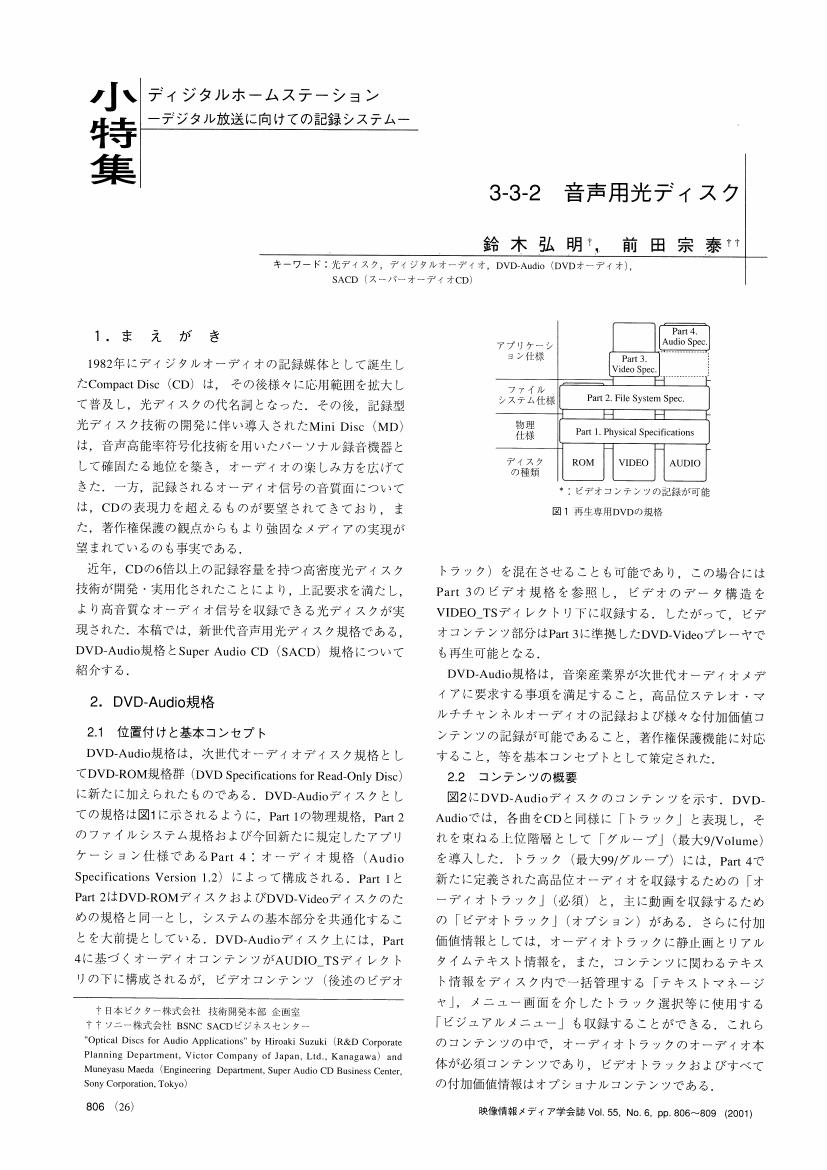

2 0 0 0 OA 音声用光ディスク

- 著者

- 鈴木 弘明 前田 宗泰

- 出版者

- 一般社団法人 映像情報メディア学会

- 雑誌

- 映像情報メディア学会誌 (ISSN:13426907)

- 巻号頁・発行日

- vol.55, no.6, pp.806-809, 2001-06-20 (Released:2011-03-14)

2 0 0 0 OA マルスシステムにおける大容量ファイルの処理について

- 著者

- 鈴木弘明 蓮村誠

- 雑誌

- 情報処理学会研究報告データベースシステム(DBS)

- 巻号頁・発行日

- vol.1976, no.33(1976-DBS-032), pp.1-12, 1977-01-13

2 0 0 0 OA 第一類医薬品を購入した顧客の薬剤師サービスに対する意識調査

- 著者

- 長田 孝司 鈴木 弘誉 山田 重行 山村 恵子

- 出版者

- 一般社団法人 日本プライマリ・ケア連合学会

- 雑誌

- 日本プライマリ・ケア連合学会誌 (ISSN:21852928)

- 巻号頁・発行日

- vol.33, no.4, pp.400-407, 2010 (Released:2015-05-30)

- 参考文献数

- 10

- 被引用文献数

- 1

【目的】平成21 (2009) 年6月1日より改正薬事法が施行され, 薬剤師は第1類医薬品を購入する顧客に対して安全かつ適正な使用ができるよう情報提供を行うことが義務付けられた. 第1類医薬品に関する適切な情報を提供するために顧客の健康ニーズをアンケート調査した. 【方法】愛知県, 岐阜県, 三重県のドラッグスギヤマにおいて第1類医薬品を購入した顧客を対象とし, 薬剤師が購入した第1類医薬品に関する情報提供を行った後, アンケート用紙を配布した. 記入したアンケート用紙は, 郵便にて直接, 当研究室で回収した. 【結果】第1類医薬品の顧客のうち66.4%が購入を繰り返し, 77.6%が「満足」と回答した. また, 90%以上の顧客は, 購入時の薬剤師の説明について「分かりやすい」と感じているが, 64.2%の顧客が薬剤師の説明がないと買えないのは不便と思っていることも明らかとなった. そして, 今回アンケートに回答した顧客の6.0%に一般用医薬品使用後に調子が悪くなった経験があった. 【結論】添付文書を読まない顧客に対する薬剤師の説明や相談を丁寧でわかりやすいものにすることで, 第1類医薬品購入時の利便性意識を向上し, 安全で有効なセルフメディケーションの推進を加速すると考えられた.

- 著者

- 黄 明霞 藤田 素弘 鈴木 弘司

- 出版者

- Japan Society of Civil Engineers

- 雑誌

- 土木学会論文集D3(土木計画学) (ISSN:21856540)

- 巻号頁・発行日

- vol.71, no.1, pp.20-30, 2015

本研究では,カウント表示式信号機下の車両挙動として,カウント表示や監視カメラの有無などの異なる条件の中国8交差点の観測調査データに基づき,特に停止通過の車両挙動分析を行った.そして青から赤への信号切替時での車両挙動の重回帰モデル等を構築する.その結果,カウント表示がある交差点では無い交差点よりも,30-50m程度手前から減速し,最大減速度も小さくなり,停止傾向も強いことがわかった.また通過時はカウント表示有りのほうが,最大加速度や交差点進入速度が有意に小さくなることが確認できた.交差点特性として,監視カメラによる赤信号無視の取り締まりのある交差点が多いことや全赤時間が設定されていないこと及び,90m手前あたりからカウント表示が確認できるという条件の下で,カウント表示式信号機の安全特性がわかった.

2 0 0 0 OA 介護者が感じる服薬介助負担のアンケート調査

- 著者

- 鈴木 弘道 中田 智雄

- 出版者

- 日本社会薬学会

- 雑誌

- 社会薬学 (ISSN:09110585)

- 巻号頁・発行日

- vol.32, no.2, pp.48-53, 2013-12-10 (Released:2015-06-26)

- 参考文献数

- 8

- 被引用文献数

- 1

Generally, the adults can manage their own medications of prescribed drugs. However, medication assistance may be required in the elderly. The family plays a medication assistance, in home, which is afraid to be a burden on the family. In this study, we performed questionnaire survey to caregiver using our day-service center so that we study the actual situation of the medication assistance. From the result of the survey, 64% of caregivers were older than 60 years old. Sixty six percents of caregivers felt some kind of burdens for management of medicine, and 70% felt a burden for medication assistances. The multiple regression analysis showed that “the burden about management of the medicine” and “the degree of medication assistances” significantly affected a sense of the burden about medication assistances (p<0.01). In addition, from the free comment on the questionnaire, it was considered that some caregivers foster a sense of the burden about medication assistances by their strong sense of mission. From these results, it is shown that many caregivers felt a burden on medication assistance. It is suggested that the intervention of pharmacists can be reduce the burden of medication assistance.

- 著者

- 岡田 健 中鉢 欣秀 鈴木 弘 大岩 元

- 出版者

- FIT(電子情報通信学会・情報処理学会)運営委員会

- 雑誌

- 情報科学技術フォーラム一般講演論文集

- 巻号頁・発行日

- vol.2002, no.1, pp.119-120, 2002-09-13

日本語を用いてJavaバーチャルマシン(以下JavaVM)上で動作するプログラムを記述できる日本語プログラム言語を設計・実装した。JavaVMのアセンブリ言語であるバイトコードを日本語化し、アセンブラレベルの日本語開発環境を開発した。更に日本語バイトコードを改良しながら日本語プログラム言語を設計している。

2 0 0 0 非分かち書き日本語プログラミング言語のための字句解析

- 著者

- 鈴木 弘 今城 哲二 中鉢欣秀 大岩 元

- 出版者

- 一般社団法人情報処理学会

- 雑誌

- 情報処理学会論文誌プログラミング(PRO) (ISSN:18827802)

- 巻号頁・発行日

- vol.41, no.9, pp.102-102, 2000-11-15

我々は,日本人のためのプログラミング言語として,日本語による文章表現を基にしたプログラミング言語を設計し実装している.普段使用している日本語のほうが従来の英語的なプログラミング言語よりも書きやすく,読みやすいという考えに基づいている.日本語は英語のように単語を空白で区切ることなく,続けて書くのが一般的である.我々が設計しているプログラミング言語も一般的な日本語に合わせ,空白で区切ることをしない言語を前提にしている.これを分かち書きしないという意味で,非分かち書き日本語プログラミング言語とする.本論文では,非分かち書き日本語プログラミング言語,すなわちセパレータのないプログラミング言語に対しての字句解析について述べる.We design new programming language for Japanese. We think Japanese-based programming language is better than English-based programming language for Japanese. The feature of this language is that grammar are based on Japanese and tokens are not separated by space character like a sentence in Japanese. This paper discusses a lexical analysis method for non-separated Japanese-based programming language.

1 0 0 0 OA 持続腹膜透析により発見され, 胸腔鏡下に治療した横隔膜交通症の一例

- 著者

- 米地 敦 樋口 光徳 塩 豊 鈴木 弘行 藤生 浩一 管野 隆三 後藤 満一

- 出版者

- The Japanese Association for Chest Surgery

- 雑誌

- 日本呼吸器外科学会雑誌 (ISSN:09190945)

- 巻号頁・発行日

- vol.16, no.2, pp.193-198, 2002-03-15 (Released:2010-06-28)

- 参考文献数

- 12

- 被引用文献数

- 6 6

症例は56歳女性.持続腹膜透析 (continuous ambulatory peritoneal dialysis: 以下CAPDと略す) 施行中に透析液の消失と胸水貯留があり精査のために当院に入院した.胸腔腹腔シンチで横隔膜交通症と診断された.胸腔鏡下に手術施行し横隔膜に責任病変を認め外科的な治療にてCAPDの再開に成功した.横隔膜交通症は保存的に加療されることが多く, その半数でCAPDを断念し血液透析に移行している.外科的に治療された症例を検索したところ12例の報告があり, 10例でCAPDの再開に成功していた.胸腔鏡下手術は侵襲が少なく優れた術式であり, 責任病変の有無を調べるという診断的意味も含めて有効な手段だと考えられる.

1 0 0 0 OA 大規模交差点における自転車と右左折車の挙動と交錯危険性に関する分析

- 著者

- 鈴木 弘司 志村 連

- 出版者

- 公益社団法人 土木学会

- 雑誌

- 土木学会論文集D3(土木計画学) (ISSN:21856540)

- 巻号頁・発行日

- vol.74, no.5, pp.I_971-I_980, 2018 (Released:2019-01-10)

- 参考文献数

- 13

- 被引用文献数

- 1 1

本研究では,複数の大規模交差点で観測調査を行い,挙動データに基づき自転車と右左折車の交錯危険性を分析した.まず,交差点構造と自転車の危険行為の関係について相関分析した結果,左折角が大きく,横断歩道設置角が小さい場合に自転車は横断歩道外側の車道を通行する傾向があることを示した.次に,PET指標に基づく分析より,左折車と自転車の交錯頻度は横断歩道,エリアによって異なり,右折車との交錯ではエリアによる差異がないことを示した.また,判別分析の結果より,危険な交錯事象の発生要因として,横断歩道のセットバック長が長いこと,青開始後の経過時間が長い自転車の交差点進入が影響を与えていること等がわかった.また構築したモデルの感度分析より,セットバック長の縮小に伴う危険事象発生予測率の減少傾向を確認した.

1 0 0 0 OA 日本語プログラム言語“まほろば”の言語仕様と記述評価

- 著者

- 今城 哲二 鈴木 弘 大野 治 植村 俊亮

- 雑誌

- 情報処理学会論文誌プログラミング(PRO) (ISSN:18827802)

- 巻号頁・発行日

- vol.42, no.SIG02(PRO9), pp.102, 2001-02-15

約20年前からコンピュータでの漢字利用が普及し,標準プログラム言語で日本語データ処理が可能となった.日本語処理は,国際規格化されていて,いくつかの言語では,識別名にも漢字などマルチオクテット文字が使用できる.予約語まで日本語にした本格的な日本語プログラム言語も,分かち書きのレベルで,実用化されている.本発表では,分かち書きをしない,より日本語に近い日本語プログラム言語``まほろば''の設計思想と文法について述べ,プログラマおよび学生による記述実験による評価について報告する.

1 0 0 0 OA 日本語プログラム言語“まほろぱ”の文法と記述評価

- 著者

- 今城哲司 鈴木 弘 大野 治 植村 俊亮

- 雑誌

- 情報処理学会論文誌プログラミング(PRO) (ISSN:18827802)

- 巻号頁・発行日

- vol.41, no.SIG04(PRO7), pp.90, 2000-06-15

約20年前からコンピュータでの漢字利用が普及し,標準プログラム言語で日本語データ処理が可能となった.日本語処理は,国際規格化されていて,いくつかの言語では,識別名にも漢字などマルチオクラット文字が使用できる.予約語まで日本語にした本格的な日本語プログラム言語も,分かち書きのレベルで,実用化されている.本論文では,分かち書きをしない,より日本語に近い日本語プログラム言語“まほろば”の設計思想と文法について述べ,実装実験による評価について報告する.

1 0 0 0 OA 集中豪雨下の道路冠水状態と交通動画シミュレーションの開発

- 著者

- 坂本 淳 藤田 素弘 鈴木 弘司 三田村 純

- 出版者

- Geographic Information Systems Association

- 雑誌

- GIS-理論と応用 (ISSN:13405381)

- 巻号頁・発行日

- vol.14, no.1, pp.9-19, 2006-06-30 (Released:2009-05-29)

- 参考文献数

- 9

Natural disaster might cause traffic congestion, changing traffic network. In this paper, we propose the way of developing the road condition analysis, animated traffic simulations of GIS and apply to the traffic situation under the Tokai downpour by using travel survey and tachometer of the drivers who had been driving under the disaster, from 9.11 to 9.12, 2000. As a result, it was revealed that many drivers who had driven at that time had involved chronic traffic jam and it took many hours to reach to destination.

1 0 0 0 OA 日米英の経験に学ぶECBの量的緩和(QE)とEU域内格差

- 著者

- 鈴木 弘隆

- 出版者

- 日本EU学会

- 雑誌

- 日本EU学会年報 (ISSN:18843123)

- 巻号頁・発行日

- vol.2016, no.36, pp.196-216, 2016-05-30 (Released:2018-05-30)

- 参考文献数

- 42

- 被引用文献数

- 2 1

This survey paper aims to deal with idiosyncratic issues of ECB’s QE by investigating QE literatures and ECB press interviews, and present considerable points to proceed future assessment studies of QE such as portfolio-rebalancing, business-stimulating and inflation accelerating effects. In terms of QE implementation, ECB’s idiosyncratic issues are the extension of ECB’ jurisdiction over adjustment programmes’ conditionality by ESM Treaty 13(3) on countries under QE and multinational risk-sharing especially related to exit strategies of QE. EU’s inequality in this paper means both directly uneven transmission effects of QE-driven stock and asset price increase on GDP and consumption, and indirectly widening income disparity effects by cutting welfare and social security budget demanded by fiscal contraction and structural reforms under Troika’s adjustment programmes.This survey’s findings are as follows. Firstly, a cause of which QE’s businesss-stimulating effects and inflation accelerating effects are limited is balance sheet recession advocated by Richard Koo. Secondly, multinational risk sharing issues are as follows. ECB decides which countries’ government securities to buy and how many. In reality, ECB’s purchases of those are biased toward those of Germany, France, Italy, Spain and the Netherlands, which consists of almost 80% of all the purchases under QE. This bias has an influence on unevenly distributed transmission effects of QE on real economy described above. Furthermore, the decision of ECB to implement QE is not unanimous, so if any country defaults, say, Greece, ECB gets to bear fiscal burden against other countries’ will. Germany is most likely to assume responsibility for large parts of the expenses, which makes it difficult for countries in EU to build multinational risk sharing with mutual consent. Consequently, at present, those risk sharing problems relating to QE’s exit strategies are stark. If government securities interest rates possibly jump up for some reason in the future, filling its fiscal losses requires German risk sharing of fiscal transfer to financially fragile central banks. However, its fiscal transfer is strictly banned by TFEU article 123, ESCB rule article 21, and any government debt acceptance by EU institution is also strictly banned by TFEU article 125 known as no bail-out clauses. Therefore, ECB is required to deal with promotion of the fiscal union of EU or revision of the treaties described above so that multinational risk sharing functions properly in case of uncertainties under the exit of ECB’s QE in the near future.